Business

Wide income gaps shape Europe’s poverty thresholds as more than 72 million remain at risk

Millions of Europeans continue to struggle with low incomes, yet the level considered sufficient for a comfortable life differs sharply across the continent. New Eurostat data shows that more than 72 million people in the EU were classed as “at risk of poverty” in 2024, equal to 16.2 percent of the population, underscoring how living conditions vary dramatically between countries.

The impact of the slowdown in major global economies will be “smaller” on the UAE’s growth and exports due to its relatively less exposure to those markets compared to other markets across the region, the World Bank said.

Eurostat defines the at-risk-of-poverty rate as the proportion of people whose median equivalised disposable income falls below 60 percent of their national median. The agency stresses that this measure reflects low income relative to peers rather than actual deprivation, meaning it does not directly indicate whether someone is unable to meet basic needs.

Across the EU, the median equivalised income per person in 2024 was €21,582. Anyone living on less than €12,949 per year, or roughly €1,079 per month, is considered at risk of poverty. Country-level thresholds, however, reveal wide economic divides. In the EU, the level ranges from €391 per month in Bulgaria to €2,540 in Luxembourg. When including candidate countries and EFTA members, the range stretches from €201 in Turkey to €2,596 in Switzerland.

Several countries, including Latvia, Portugal, Croatia, Lithuania, Poland, Greece and Slovakia, have thresholds below €750. Hungary, Romania, Bulgaria, Serbia and Turkey fall below €500. Among the EU’s largest economies, Germany records the highest threshold at €1,381, followed by France at €1,278, Italy at €1,030 and Spain at €965.

For households, the gap becomes even more visible. A family of two adults with two children under 14 faces a threshold 2.1 times higher than that of a single person. This equals €2,266 in the EU, €423 in Turkey and €5,452 in Switzerland.

Economists note that these variations reflect differences in productivity and industrial structure. Giulia De Lazzari of the International Labour Organization said countries with strong finance, technology or advanced manufacturing sectors tend to generate higher wages, which lifts their poverty thresholds.

The gaps narrow when measured in purchasing power standards, designed to account for price differences. Even then, significant contrasts remain. In PPS terms, thresholds range from 449 in Serbia to 1,889 in Luxembourg. Turkey, Hungary, Slovakia and Greece rank among the lowest, while Norway, Switzerland, Austria and the Netherlands sit near the top. Among major economies, Germany has the highest threshold, with France next. Spain and Italy are both recorded at 1,060.

Eurostat’s 2024 figures show that the overall at-risk-of-poverty rate stands at 16.2 percent across the EU. The lowest rate is found in Czechia at 9.5 percent, while Turkey and North Macedonia exceed 22 percent. Many Balkan and Eastern European countries register higher exposure. Among Europe’s largest economies, Spain has a rate of 19.7 percent and Italy 18.9 percent, while France at 15.9 percent and Germany at 15.5 percent remain slightly below the EU average.

Business

EU Household Energy Prices Remain Above Pre-War Levels Despite Stabilisation

Residential electricity and natural gas prices across the European Union remain higher than before Russia’s invasion of Ukraine, even though markets have steadied in recent years.

The war, which began in February 2022 and has now entered its fifth year, reshaped Europe’s energy landscape. According to the European Council, Russia’s share of EU pipeline gas imports fell sharply from around 40 per cent in 2021 to about 6 per cent in 2025, following sanctions, embargoes and efforts to diversify supplies.

New data from Eurostat show that between the first half of 2021 and the first half of 2025, household electricity prices in the EU rose 30 per cent, from 22 cents per kilowatt-hour to 28.7 cents. Over the same period, natural gas prices climbed 79 per cent, from 6.4 cents to 11.4 cents per kilowatt-hour.

The Household Energy Price Index (HEPI), compiled by Energie-Control Austria, MEKH and VaasaETT, tracks monthly end-user prices in European capital cities. Its January 2026 figures indicate that electricity prices across EU capitals were 5 per cent higher than in January 2022. However, compared with January 2021, prices were up 38 per cent.

Some cities experienced particularly sharp increases over the five-year period. Electricity prices more than doubled in Vilnius, rising 102 per cent. Other large jumps were recorded in Bucharest (88 per cent), Bern (86 per cent), Kyiv (77 per cent), Amsterdam (75 per cent), Riga (74 per cent), Brussels (67 per cent) and London (64 per cent).

Only Copenhagen and Budapest posted declines over that period, at minus 16 per cent and minus 8 per cent respectively.

Among the capitals of Europe’s five largest economies, London and Rome saw notable increases, while Madrid and Berlin recorded relatively modest rises. Paris remained below the EU average increase.

Energy analysts at the European Energy and Climate Policy (IEECP) say the electricity mix has been a decisive factor. Countries such as Spain benefit from a higher share of wind, solar and hydropower, while Nordic nations rely heavily on hydropower, geothermal and wind energy, reducing exposure to fossil fuel price swings.

Looking only at the period from January 2022 to January 2026 presents a different trend. Copenhagen recorded a 44 per cent fall in electricity prices, while London, Madrid, Berlin and Rome also saw declines. Paris, by contrast, registered a 21 per cent increase. Vilnius showed the largest EU rise at 70 per cent, while Kyiv topped the overall list at 87 per cent.

Natural gas prices across EU capitals edged down by 1 per cent between January 2022 and January 2026. Berlin, Brussels and Athens recorded declines of around 40 per cent, while Riga, Warsaw and Lisbon saw strong increases.

Despite the recent stabilisation, household energy bills across much of Europe remain well above pre-invasion levels, reflecting the lasting impact of the energy crisis.

Business

Transatlantic Tensions on Digital Rules Highlight Need for Cooperation

Discussions between Europe and the United States over digital regulation continue to be marked by miscommunication and frustration, even as competitors observe from the sidelines. Europeans and Americans talk past each other while rivals watch. The European Union can set its own standards, but in an interconnected economy, decoupling fantasies and grandstanding won’t help.

The debate often centres on “free speech” concerns voiced by U.S. tech companies and policymakers in response to the EU’s legislative framework for digital platforms. In Europe, such narratives typically prompt defensive reactions. Some Europeans respond with a blunt message: “This is our land, our Union, our laws, follow them, or leave the EU—we’ll find alternative products to use!” Public awareness of American constitutional amendments is low across Europe, just as Americans pay little attention to European digital acts and regulations.

The transatlantic dialogue is further complicated by the global nature of social media platforms. Any EU legislation affecting user experience inevitably influences the functioning of these platforms worldwide, touching on what Americans see as free speech rights. The EU also seeks to extend its influence through the “Brussels effect,” ensuring that European rules shape global standards, while the U.S. maintains a large trade surplus in services and competes technologically with China. This mix of economic, political, and regulatory factors explains why U.S. attention is sharply focused on Europe’s digital policies.

Europeans argue that their 450-million-consumer market has the right to set rules that reflect local principles and values. Attempts to adjust or simplify regulations are difficult, with efforts often met with political resistance and scrutiny. The regulatory ecosystem in Europe supports industries of lawyers, consultants, and experts whose work depends on maintaining complex rules, making reform a sensitive topic.

On the American side, anti-EU rhetoric by public figures has sometimes compounded the problem, drowning out moderates and reinforcing defensive European responses. Analysts note that both regions have seen productive voices sidelined as grandstanding and negative statements dominate public discourse.

Observers argue that long-term thinking is necessary. By evaluating the EU-U.S. tech partnership in the broader context of global alliances, including China and Russia, policymakers can better assess priorities and avoid unnecessary disruption. Blank-slate decoupling between Europe and the United States is unrealistic, and delaying constructive dialogue risks broader economic consequences.

Experts warn that continued transatlantic infighting benefits other global powers and weakens the ability of both regions to set coherent standards in emerging technologies. The message from analysts is clear: cooperation, not confrontation, will determine whether the EU and U.S. can maintain leadership in digital regulation while safeguarding economic and technological interests.

Business

Christine Lagarde’s Future at ECB Sparks Speculation Amid Reports of Early Departure

Reports on Wednesday suggested that Christine Lagarde could step down as president of the European Central Bank before her eight-year term officially ends in October 2027. An ECB spokesperson told Euronews that no decision has been made and emphasized that Lagarde remains focused on her mandate.

The central bank’s response was less categorical than last year, when similar rumours surfaced. The ECB previously stressed that Lagarde was “fully determined to complete her term,” but Wednesday’s statement offered a more measured tone.

The initial report, published by the Financial Times citing a source familiar with the matter, claimed that Lagarde may vacate her post ahead of the French elections in April 2027. Leaving the ECB before the vote would allow outgoing French President Emmanuel Macron and German Chancellor Friedrich Merz to influence the selection of her successor, potentially shaping the future of European monetary policy.

Macron is barred by the French constitution from seeking a third term, while polls show strong support for far-right candidates, including Marine Le Pen and her protégé Jordan Bardella. In Germany, the Alternative for Germany (AfD) party is gaining traction, raising concerns among Brussels and Paris officials that a Eurosceptic shift could complicate appointments to key EU institutions.

The speculation over Lagarde’s departure follows last week’s announcement that François Villeroy de Galhau, Governor of the Bank of France, would step down early. Speaking to a parliamentary committee, Villeroy de Galhau commented on the rumours about Lagarde: “I read a rumour about Lagarde, I discovered it, it doesn’t seem [like] information to me, I’ll leave it to the ECB to comment.”

Attention is now turning to potential successors in Frankfurt. An FT poll in December highlighted Klaas Knot, former governor of the Dutch central bank, and Pablo Hernández de Cos, former Bank of Spain governor, as leading candidates.

Knot is seen as a seasoned central banker who has shifted from a strict inflation-focused approach to a more moderate, consensus-driven stance. His profile appeals to Berlin, where Chancellor Merz may prefer a Dutch candidate over the potential complexities of appointing a German. Hernández de Cos, who currently heads the Bank for International Settlements, is regarded as a strong contender because of his technical expertise and reputation as a collaborative leader.

Observers suggest that the coming months could be decisive for the ECB, as political timing in France and Germany may influence the selection process. Analysts say the combination of rising far-right influence and strategic maneuvering by incumbent leaders could accelerate decisions about Lagarde’s replacement.

While the ECB stresses that no formal decision has been made, speculation over Lagarde’s future is likely to intensify, with European economists and policymakers closely monitoring developments that could reshape leadership at one of the continent’s most influential financial institutions.

-

Entertainment2 years ago

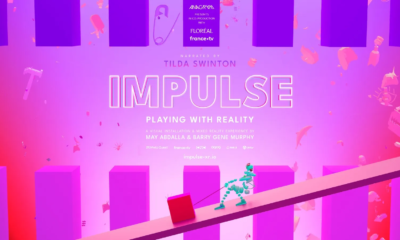

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1