Business

Big Tech to Spend Over $700 Billion on AI in 2026, Outpacing Entire Economies

Big Tech companies are dramatically increasing their investments in artificial intelligence, with projected capital expenditure for 2026 exceeding $700 billion (€590 billion), an increase of roughly 75 percent from 2025. The figure represents more than Sweden’s entire nominal GDP for 2025 and highlights the scale of the technology sector’s AI push.

Recent earnings reports and analyst projections show that Amazon is leading the spending, guiding an estimated $200 billion (€170 billion) in AI infrastructure. Alphabet, Microsoft, and Meta follow with planned investments of $185 billion (€155 billion), $145 billion (€122 billion), and $135 billion (€113 billion), respectively. Oracle, Tesla, and xAI are also scaling up spending, with Tesla aiming for nearly $20 billion (€16.8 billion) to expand its robotaxi fleet and Optimus humanoid projects, while xAI will invest at least $30 billion (€25.2 billion).

The surge in spending reflects a definitive pivot that began in 2025, when Big Tech invested around $400 billion (€337 billion) in AI infrastructure. Hyperscale data centres, AI chip development, and cloud computing expansion are driving the demand, with global chip sales expected to reach $1 trillion (€842 billion) this year for the first time, according to the US Semiconductor Industry Association. Nvidia, a leading AI chip supplier, is set to benefit heavily from this build-out, with CEO Jensen Huang describing the effort as “the largest infrastructure build-out in human history.”

Big Tech is financing much of the expansion through debt, with Morgan Stanley estimating that hyperscalers will borrow approximately $400 billion (€337 billion) in 2026, more than double the amount in 2025. Analysts have raised concerns about the scale and timing of spending, citing potential risks from rapid hardware depreciation and high operational costs, including energy usage. Google CEO Sundar Pichai acknowledged that there are “elements of irrationality in the current spending pace,” while investors like Michael Burry have warned the AI investment boom may resemble a bubble.

Europe’s position in the AI race contrasts sharply with the US. Total European spending on sovereign cloud infrastructure is forecast at €10.6 billion in 2026, a fraction of American Big Tech investments. Mistral AI, a French startup, represents one of the few significant European moves, planning a €1.2 billion data centre in Borlänge, Sweden, to provide high-performance computing for AI models and strengthen EU data sovereignty.

While US companies dominate with enormous investments, European firms are relying on regulation and targeted capital projects to carve out a competitive position. Analysts warn that the transatlantic gap underscores Europe’s reliance on American technology and raises questions about its ability to compete in a rapidly expanding global AI market.

As 2026 unfolds, the stakes for Big Tech and global AI leadership are clear. The United States is making unprecedented financial bets on AI dominance, while Europe attempts to balance regulation, sovereign infrastructure, and limited capital to maintain a foothold in the emerging technology landscape.

Business

Oil Prices Drop as Trump Signals Possible Easing of Sanctions Amid Middle East Tensions

Business

Oil Prices Surge as Iran War Raises Fears Over Global Energy Supplies

Business

Iran’s Strikes Across Gulf and Azerbaijan Disrupt Global Energy Markets

Iran’s apparent erratic strikes all over the Gulf and now Azerbaijan, together with its stranglehold of the vital Strait of Hormuz, have resulted in a growing strain on the world’s global energy supplies with incalculable consequences ahead. During the US-Israeli military buildup preceding the war that erupted one week ago, Iran repeatedly warned it would retaliate if attacked, promising widespread disruption.

Since the conflict began last Saturday, Tehran has expanded its aerial campaign across the Gulf and, on Thursday, extended attacks to Azerbaijan. While Iranian officials claim the strikes target only US and Israeli interests, missiles and drones have also hit the Gulf’s energy infrastructure, essential to global supply chains, and disrupted shipping lanes in the Strait of Hormuz, where roughly 20% of the world’s oil passes. Lloyd’s List reported that more than 200 ships remain stranded due to restricted movement in the strait.

Qatar halted liquefied natural gas (LNG) production at its top facilities in Mesaieed and Ras Laffan Industrial City after drone attacks, sending shockwaves through global energy markets. Qatar’s LNG supplies account for around 20% of the world’s total and play a key role in balancing demand across Asia and Europe. Iranian strikes also forced Saudi Arabia’s largest oil refinery to suspend operations, while Iraqi oil production and Israeli gas fields suffered disruptions. Dubai’s ports, among the world’s busiest, were reportedly impacted as well.

The UK Foreign Office said Friday that while the tempo of Iranian missile and drone strikes has slowed since the war’s early days, their focus is increasingly on economic and energy targets. In an interview with the Financial Times, Qatar’s Energy Minister Saad al-Kaabi warned the conflict “could bring down the economies of the world,” adding that continued hostilities would push energy prices higher and trigger shortages affecting industries worldwide.

Experts highlight the potential for a wider economic impact if the Strait of Hormuz remains blocked. Dr. Yousef Alshammari, president of the London College of Energy Economics, told Euronews that such a blockade “could trigger a global recession if it continues,” citing potential political pressure from China, a major consumer of Iranian oil.

Former US ambassador to Azerbaijan Matthew Bryza criticized Iran’s attack on Azerbaijan as lacking strategic logic, noting that Tehran’s actions “don’t make much sense in terms of a coherent, rational military plan.” Bryza suggested that some strikes may reflect decisions by lower-level commanders following directives from Iran’s supreme leader to delegate military authority if senior officials were killed, rather than a coordinated strategy.

The ongoing strikes have caused oil and gas prices to surge, with European gas already up more than 50%, and global markets remain on high alert. Analysts warn that disruptions could escalate further, amplifying the economic toll and keeping international energy markets under pressure as the conflict continues.

-

Entertainment2 years ago

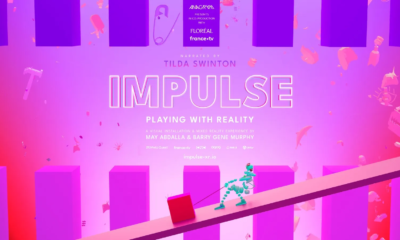

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1