Business

Top European CEOs Urge Two-Year Delay in AI Act Implementation

Business

European Gas Prices Jump as Middle East Tensions Rattle LNG Markets

Gas prices in Europe surged on Tuesday as escalating tensions in the Middle East disrupted global energy flows and raised fears of tighter liquefied natural gas supplies, increasing concerns about the region’s fragile energy recovery.

Europe’s benchmark Dutch TTF gas contract climbed above €60 per megawatt hour around 12:30 CET, a sharp rise from the low €30s recorded at the end of last week. The spike followed US and Israeli strikes on Iran, which unsettled global markets and renewed anxiety about potential supply disruptions.

“This has triggered immediate fears of reduced LNG availability to Europe, prompting a rush in spot markets and heightened risk premiums,” said Yousef M. Alshammari, president of the London College of Energy Economics.

Traders are closely watching LNG shipments from Qatar and maritime traffic through the Strait of Hormuz, a key chokepoint for global energy trade. Any disruption to flows through the strait could tighten supply and intensify competition for cargoes, particularly between Europe and Asian buyers.

Europe has reduced its reliance on Russian pipeline gas since Moscow’s invasion of Ukraine, replacing much of that supply with seaborne LNG. While this shift has improved diversification, it has also increased dependence on global shipping routes and spot market cargoes, both of which can become volatile during geopolitical crises.

Qatar accounts for an estimated 12 to 14 percent of Europe’s LNG imports, making developments in the Gulf region particularly significant. Analysts at Brussels-based think tank Bruegel said that even though Europe is less dependent on Gulf oil and LNG than major Asian economies, it remains exposed to global price swings.

Gas storage levels add to the concern. European Union storage facilities are around 30 percent full, lower than at the same point last year. Germany’s inventories stood at about 21.6 percent in late February, with France also reporting levels in the low 20s. Lower reserves could complicate efforts to rebuild stocks ahead of next winter if high prices persist.

Alshammari warned that a prolonged period of elevated wholesale prices could eventually filter through to households and businesses. While many consumers are protected by fixed or regulated tariffs that adjust gradually, sustained prices above €50–60 per megawatt hour could push up electricity and heating bills in the coming months.

Energy-intensive industries such as chemicals, fertilisers, steel, glass and paper manufacturing are likely to face renewed cost pressures. Countries including Germany, Italy and the Netherlands could see competitiveness affected if prices remain high.

Lower-income households in Central and Eastern Europe, as well as parts of southern Europe, may also be vulnerable due to greater reliance on gas for heating and less energy-efficient housing. Governments may need to consider targeted measures if the current disruptions continue and market volatility persists.

Business

Oil Tanker Attacked in Strait of Hormuz, Crew Evacuated

An oil tanker was attacked off the coast of Musandam in the Strait of Hormuz on Sunday, leaving four people injured and prompting the evacuation of all 20 crew members, according to Oman’s Maritime Security Centre.

The vessel, named Skylight and flying the flag of the Republic of Palau, was targeted around five nautical miles (9.26 km) north of Khasab Port, Oman authorities said. The incident marked the first reported attack on a ship in the strategic Strait of Hormuz on Sunday morning.

Oman’s Maritime Security Centre confirmed that the tanker’s crew included 15 Indian nationals and five Iranian nationals, all of whom were safely evacuated. The four injured crew members were transferred for medical treatment. Authorities did not immediately provide details on the cause of the attack or the identities of the attackers.

The incident has heightened concerns about shipping safety in one of the world’s most important oil transit routes. The Strait of Hormuz handles a significant portion of global crude oil exports, and any disruption to its operations can have major implications for energy markets.

In response to the attack, major shipping companies have suspended operations through the Strait of Hormuz. Danish shipping and logistics giant Maersk announced on Sunday afternoon that it had halted all future transits through the waterway until further notice. Other operators are reportedly reviewing their shipping schedules and implementing additional safety measures.

The attack comes amid ongoing regional tensions, with the Strait of Hormuz often at the center of geopolitical disputes. Analysts say the incident could lead to further disruptions in global oil supplies and push energy prices higher if shipping companies continue to avoid the area.

Maritime security experts emphasize the need for close monitoring of shipping traffic and coordinated responses to ensure the safety of vessels and crews in the region. The rapid evacuation of Skylight’s crew has been described as a positive example of emergency preparedness, but the attack underscores the continuing risks faced by commercial shipping in the Gulf.

Authorities are continuing to investigate the circumstances of the attack and are coordinating with international maritime agencies to prevent further incidents. The situation remains fluid, and the potential impact on shipping and regional security is likely to unfold in the coming days.

Business

EU Household Energy Prices Remain Above Pre-War Levels Despite Stabilisation

Residential electricity and natural gas prices across the European Union remain higher than before Russia’s invasion of Ukraine, even though markets have steadied in recent years.

The war, which began in February 2022 and has now entered its fifth year, reshaped Europe’s energy landscape. According to the European Council, Russia’s share of EU pipeline gas imports fell sharply from around 40 per cent in 2021 to about 6 per cent in 2025, following sanctions, embargoes and efforts to diversify supplies.

New data from Eurostat show that between the first half of 2021 and the first half of 2025, household electricity prices in the EU rose 30 per cent, from 22 cents per kilowatt-hour to 28.7 cents. Over the same period, natural gas prices climbed 79 per cent, from 6.4 cents to 11.4 cents per kilowatt-hour.

The Household Energy Price Index (HEPI), compiled by Energie-Control Austria, MEKH and VaasaETT, tracks monthly end-user prices in European capital cities. Its January 2026 figures indicate that electricity prices across EU capitals were 5 per cent higher than in January 2022. However, compared with January 2021, prices were up 38 per cent.

Some cities experienced particularly sharp increases over the five-year period. Electricity prices more than doubled in Vilnius, rising 102 per cent. Other large jumps were recorded in Bucharest (88 per cent), Bern (86 per cent), Kyiv (77 per cent), Amsterdam (75 per cent), Riga (74 per cent), Brussels (67 per cent) and London (64 per cent).

Only Copenhagen and Budapest posted declines over that period, at minus 16 per cent and minus 8 per cent respectively.

Among the capitals of Europe’s five largest economies, London and Rome saw notable increases, while Madrid and Berlin recorded relatively modest rises. Paris remained below the EU average increase.

Energy analysts at the European Energy and Climate Policy (IEECP) say the electricity mix has been a decisive factor. Countries such as Spain benefit from a higher share of wind, solar and hydropower, while Nordic nations rely heavily on hydropower, geothermal and wind energy, reducing exposure to fossil fuel price swings.

Looking only at the period from January 2022 to January 2026 presents a different trend. Copenhagen recorded a 44 per cent fall in electricity prices, while London, Madrid, Berlin and Rome also saw declines. Paris, by contrast, registered a 21 per cent increase. Vilnius showed the largest EU rise at 70 per cent, while Kyiv topped the overall list at 87 per cent.

Natural gas prices across EU capitals edged down by 1 per cent between January 2022 and January 2026. Berlin, Brussels and Athens recorded declines of around 40 per cent, while Riga, Warsaw and Lisbon saw strong increases.

Despite the recent stabilisation, household energy bills across much of Europe remain well above pre-invasion levels, reflecting the lasting impact of the energy crisis.

-

Entertainment2 years ago

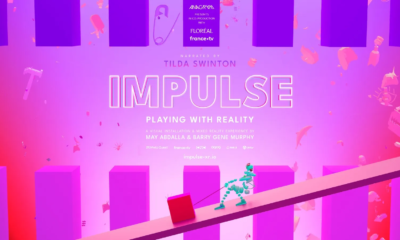

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1