Business

Christine Lagarde’s Future at ECB Sparks Speculation Amid Reports of Early Departure

Reports on Wednesday suggested that Christine Lagarde could step down as president of the European Central Bank before her eight-year term officially ends in October 2027. An ECB spokesperson told Euronews that no decision has been made and emphasized that Lagarde remains focused on her mandate.

The central bank’s response was less categorical than last year, when similar rumours surfaced. The ECB previously stressed that Lagarde was “fully determined to complete her term,” but Wednesday’s statement offered a more measured tone.

The initial report, published by the Financial Times citing a source familiar with the matter, claimed that Lagarde may vacate her post ahead of the French elections in April 2027. Leaving the ECB before the vote would allow outgoing French President Emmanuel Macron and German Chancellor Friedrich Merz to influence the selection of her successor, potentially shaping the future of European monetary policy.

Macron is barred by the French constitution from seeking a third term, while polls show strong support for far-right candidates, including Marine Le Pen and her protégé Jordan Bardella. In Germany, the Alternative for Germany (AfD) party is gaining traction, raising concerns among Brussels and Paris officials that a Eurosceptic shift could complicate appointments to key EU institutions.

The speculation over Lagarde’s departure follows last week’s announcement that François Villeroy de Galhau, Governor of the Bank of France, would step down early. Speaking to a parliamentary committee, Villeroy de Galhau commented on the rumours about Lagarde: “I read a rumour about Lagarde, I discovered it, it doesn’t seem [like] information to me, I’ll leave it to the ECB to comment.”

Attention is now turning to potential successors in Frankfurt. An FT poll in December highlighted Klaas Knot, former governor of the Dutch central bank, and Pablo Hernández de Cos, former Bank of Spain governor, as leading candidates.

Knot is seen as a seasoned central banker who has shifted from a strict inflation-focused approach to a more moderate, consensus-driven stance. His profile appeals to Berlin, where Chancellor Merz may prefer a Dutch candidate over the potential complexities of appointing a German. Hernández de Cos, who currently heads the Bank for International Settlements, is regarded as a strong contender because of his technical expertise and reputation as a collaborative leader.

Observers suggest that the coming months could be decisive for the ECB, as political timing in France and Germany may influence the selection process. Analysts say the combination of rising far-right influence and strategic maneuvering by incumbent leaders could accelerate decisions about Lagarde’s replacement.

While the ECB stresses that no formal decision has been made, speculation over Lagarde’s future is likely to intensify, with European economists and policymakers closely monitoring developments that could reshape leadership at one of the continent’s most influential financial institutions.

Business

European Savers Missing Major Wealth-Building Opportunity, EFAMA Chief Says

Business

Big Tech to Spend Over $700 Billion on AI in 2026, Outpacing Entire Economies

Big Tech companies are dramatically increasing their investments in artificial intelligence, with projected capital expenditure for 2026 exceeding $700 billion (€590 billion), an increase of roughly 75 percent from 2025. The figure represents more than Sweden’s entire nominal GDP for 2025 and highlights the scale of the technology sector’s AI push.

Recent earnings reports and analyst projections show that Amazon is leading the spending, guiding an estimated $200 billion (€170 billion) in AI infrastructure. Alphabet, Microsoft, and Meta follow with planned investments of $185 billion (€155 billion), $145 billion (€122 billion), and $135 billion (€113 billion), respectively. Oracle, Tesla, and xAI are also scaling up spending, with Tesla aiming for nearly $20 billion (€16.8 billion) to expand its robotaxi fleet and Optimus humanoid projects, while xAI will invest at least $30 billion (€25.2 billion).

The surge in spending reflects a definitive pivot that began in 2025, when Big Tech invested around $400 billion (€337 billion) in AI infrastructure. Hyperscale data centres, AI chip development, and cloud computing expansion are driving the demand, with global chip sales expected to reach $1 trillion (€842 billion) this year for the first time, according to the US Semiconductor Industry Association. Nvidia, a leading AI chip supplier, is set to benefit heavily from this build-out, with CEO Jensen Huang describing the effort as “the largest infrastructure build-out in human history.”

Big Tech is financing much of the expansion through debt, with Morgan Stanley estimating that hyperscalers will borrow approximately $400 billion (€337 billion) in 2026, more than double the amount in 2025. Analysts have raised concerns about the scale and timing of spending, citing potential risks from rapid hardware depreciation and high operational costs, including energy usage. Google CEO Sundar Pichai acknowledged that there are “elements of irrationality in the current spending pace,” while investors like Michael Burry have warned the AI investment boom may resemble a bubble.

Europe’s position in the AI race contrasts sharply with the US. Total European spending on sovereign cloud infrastructure is forecast at €10.6 billion in 2026, a fraction of American Big Tech investments. Mistral AI, a French startup, represents one of the few significant European moves, planning a €1.2 billion data centre in Borlänge, Sweden, to provide high-performance computing for AI models and strengthen EU data sovereignty.

While US companies dominate with enormous investments, European firms are relying on regulation and targeted capital projects to carve out a competitive position. Analysts warn that the transatlantic gap underscores Europe’s reliance on American technology and raises questions about its ability to compete in a rapidly expanding global AI market.

As 2026 unfolds, the stakes for Big Tech and global AI leadership are clear. The United States is making unprecedented financial bets on AI dominance, while Europe attempts to balance regulation, sovereign infrastructure, and limited capital to maintain a foothold in the emerging technology landscape.

Business

AI Anxiety Sparks Major Sell-Off in Global Software Stocks

The software sector is facing its steepest market decline since the 2008 financial crisis, driven not by a banking collapse but by fears over artificial intelligence. “AI anxiety is reshaping the software sector’s landscape. What started as a US sell-off has become a reckoning for Europe’s tech giants,” analysts said.

In the United States, the sector fell 14.5% in January, marking its worst monthly performance since October 2008. The decline accelerated in early February, dropping another 10% in less than two weeks. Investor concerns have centered on the possibility that AI tools could not only enhance existing software products but also erode subscription-based business models that have supported growth for over a decade.

High-profile companies have experienced dramatic reversals. Unity Software, Rapid7, and Braze have each lost more than half their market value since the start of the year. Even major players such as Palantir, Salesforce, Intuit, and ServiceNow have fallen around 30% year-to-date. The sell-off was intensified by Anthropic’s January launch of new enterprise plugins for its Claude AI assistant, prompting investors to question whether traditional software platforms remain essential.

The tremors in the U.S. have spread to Europe, where the software sector, valued at roughly €300 billion, is concentrated among a few key companies. Germany’s SAP, the region’s largest software firm with a market capitalisation of about €200 billion, has dropped roughly 20% year-to-date and 40% since its February 2025 peak. The company is heading for its ninth straight month of decline, a streak unseen in over three decades.

France’s Dassault Systèmes, a leader in 3D design software, has fallen 25% since January, approaching its fifth consecutive month of losses, the longest since 2016. British software provider Sage Group has also dropped about 25% year-to-date, including a 17% slide in February, marking its weakest monthly performance since 2002. RELX, a UK information and analytics company, fell 17% in a single session earlier this month, its steepest daily decline since 1988.

Mid-sized European firms have faced even sharper declines. Sidetrade, a French AI-based order-to-cash platform, has lost nearly 50% of its value this year. Sweden’s Lime Technologies, Denmark’s cBrain, and Norway’s LINK Mobility Group are down between 32% and 38%, reflecting the sector’s sensitivity to investor sentiment.

Experts are divided on the outlook. Nvidia CEO Jensen Huang dismissed fears that AI will replace software entirely, calling it “the most illogical thing in the world,” and suggesting AI will enhance existing systems. Wedbush Securities and JP Morgan strategists have argued that the market is pricing in worst-case disruption scenarios unlikely to materialise soon.

Yet Goldman Sachs strategist Ben Snider warned of “long-term downside risk,” comparing the sector to industries that underestimated structural change, such as newspapers and tobacco. Veteran investor Ed Yardeni described the shift from “AI-phoria to AI-phobia,” suggesting valuations may now reflect potential slowdowns rather than immediate collapse.

The software sector is not disappearing, but AI is forcing investors to rethink how value is created. Companies that adapt effectively may emerge stronger, while others could see margins and pricing power challenged. The industry’s competitive landscape is likely to look very different in the years ahead.

-

Entertainment1 year ago

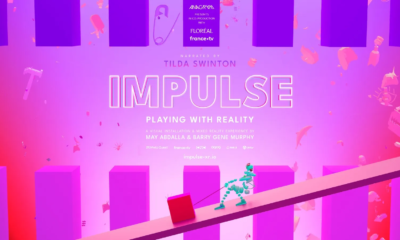

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1