Business

European Bank Stocks Post Record Gains in 2025, Eyes Turn to Growth in 2026

European bank stocks recorded their strongest year on record in 2025, driven by resilient economic growth, high profit margins, and robust capital returns. Investors are now focusing on earnings growth, efficiency improvements, and sustained shareholder payouts as the sector enters 2026.

The EURO STOXX Banks Index surged 76 percent year-to-date as of December 12, surpassing the previous record gain of 74 percent in 1997. Every constituent of the index posted positive returns, with several banks achieving triple-digit gains. Notable performers include Société Générale and Commerzbank, which rose 139 percent and 136 percent respectively. Spain’s Banco Santander climbed 110 percent, while ABN Amro increased 102 percent. Other strong performers included BBVA (+101%), CaixaBank (+96%), Deutsche Bank (+92%), Bankinter (+86%), and Bank of Ireland (+84%).

Analysts attribute the rally to a combination of favourable macroeconomic conditions. Interest rates remained high enough to support net interest margins, economic growth stayed strong enough to protect asset quality, and banks maintained capital buffers that allowed generous shareholder distributions. The European Central Bank paused its rate-cutting cycle in June 2025, keeping the deposit facility rate at 2 percent. While below the peaks of 2023–24, these levels were above pre-pandemic norms, helping lenders preserve elevated margins.

Economic performance across the eurozone exceeded expectations. Germany avoided a deep industrial recession, southern Europe benefited from strong tourism and EU investment flows, and fiscal policy remained mildly supportive. Credit conditions held steady, loan losses stayed contained, and investor confidence in bank balance sheets strengthened. Strong capital levels allowed banks to increase dividends, share buybacks, and other forms of shareholder returns.

Valuations also contributed to the rally. European banks began 2025 trading at substantial discounts to book value and global peers, reflecting years of negative interest rates, heavy regulation, and subdued profitability. Global portfolio flows further supported the sector, with international investors rotating into European value stocks and financials, aided by a stronger euro.

Looking ahead to 2026, analysts remain broadly optimistic. Goldman Sachs analyst Chris Hallam said investor attention is likely to shift from interest rates and credit to growth and efficiency. He expects ongoing deposit inflows, deposit-focused strategies, and gradual loan growth to drive earnings. Returns are projected to remain in the mid-teens over the medium term, supported by well-capitalised banks capable of deploying capital through organic growth, selective mergers and acquisitions, and shareholder distributions.

Goldman Sachs highlighted high-conviction European bank stocks with potential upside, including UBS Group (34%), UniCredit (29%), Banco BPM (29%), Julius Baer (25%), Alpha Bank (21%), and KBC Group (21%). Analysts suggest that, even after a historic 2025, the sector’s rally may not yet be complete.

After a record-breaking year, European banks are entering 2026 not just as a recovery story but as a sector increasingly evaluated on growth execution, efficiency gains, and disciplined capital management.

Business

China’s Cheap Exports Challenge Latin American Industries Amid Rising Trade Tensions

China is flooding Latin America with low-priced exports, putting pressure on local industries and forcing governments to weigh protectionist measures against Beijing’s growing influence in the region. The surge in Chinese imports comes as US tariffs curb exports to the United States, prompting Chinese businesses to seek alternative markets for cars, electronics, clothing, and household goods.

Latin America, with a population exceeding 600 million and a growing middle class, has become an attractive destination for Chinese exporters. “Latin America has a solid middle class, relatively high purchasing power and real demand,” said Margaret Myers, director of the Asia and Latin America programme at the Inter-American Dialogue think tank. “Those conditions make it one of the easiest places for China to offload excess industrial production.”

The influx of Chinese goods is affecting local businesses. Argentina has seen factory closures and layoffs in its manufacturing sector, which employs nearly a fifth of the workforce. The volume of e-commerce imports, mostly from China, surged 237% in October compared with the same month in 2024, according to government statistics. Claudio Drescher, head of Argentina’s chamber of industry, said the influx of ultra-fast fashion is “deeply worrying” and putting domestic producers under pressure.

Online platforms such as Temu and Shein have accelerated the trend. Temu reported 114 million monthly active users in Latin America in the first half of 2025, up 165% from the previous year. Shein also expanded its user base by 18% over the same period. Consumers are benefiting from lower prices, but local stores are struggling to compete. In downtown Mexico City, shops selling Chinese-made goods have more than tripled in recent years, displacing some long-established retailers.

The car industry is also under strain. Brazil and Mexico, the region’s main vehicle producers, are seeing Chinese electric vehicles gain market share. In Brazil, more than 80% of the 61,615 EVs sold in 2024 were Chinese brands. Mexico imported over 625,000 Chinese vehicles last year, surpassing Russia as the top destination for Chinese exports. While local production remains strong, Chinese companies such as BYD and GWM are building factories in the region to expand their presence.

Trade imbalances are widening. Mexico’s deficit with China reached $120 billion in 2024, while Argentina’s trade deficit rose to nearly $8.2 billion in 2025. China primarily exports manufactured goods to the region while importing raw materials such as copper, lithium, and soybeans. Beyond trade, Beijing has provided $153 billion in loans and grants to Latin America and the Caribbean between 2014 and 2023, compared with roughly $50 billion from the US.

Governments are beginning to respond. Mexico has imposed tariffs up to 50% on certain Chinese imports, while Brazil is increasing duties on electric vehicles and curbing tax exemptions for small parcels. Chile has raised tariffs and introduced a 19% value-added tax on low-value imports. Analysts warn, however, that countries face limits in pushing back without risking economic or political retaliation from China.

“Many countries don’t feel they have the space to resist China’s export surge,” Myers said. “The relationship has become too important economically, despite concerns about competitiveness.”

Business

Gold and Silver Extend Historic Losses Following Warsh Nomination

Gold and silver prices plunged further on Monday, extending last week’s dramatic sell-off after President Donald Trump nominated Kevin Warsh as the next chair of the US Federal Reserve. The nomination intensified debate over the Fed’s future monetary policy and potential political pressures, prompting investors to reassess positions across precious metals.

Spot gold fell as much as 10% in early trading, while silver tumbled up to 16%, following Friday’s historic decline that marked the largest intraday drop on record for the white metal. The sharp retreat reflected how heavily invested markets had become after months of strong gains driven by geopolitical tensions and expectations of easier US policy.

“Crowded one-sided trades unwind. FOMO and chasing the rally are rarely, if ever, a case of economic fundamentals,” said Marcus Dewsnap, head of fixed income strategy at Informa Global Markets. “Reality seems to have caught up with metals markets after a parabolic rise.”

The sell-off was triggered by Warsh’s nomination, which pushed the US dollar higher and forced investors to reprice expectations for interest rates. “The sharp decline on Friday followed news that Trump intends to nominate Kevin Warsh as the next Federal Reserve chair – a development that boosted the dollar and reinforced expectations of a more hawkish policy stance,” said Ewa Manthey, commodities strategist at ING, alongside Warren Patterson, head of commodities strategy.

Gold and silver are particularly sensitive to US rate expectations, as higher interest rates increase the opportunity cost of holding non-yielding assets. A stronger dollar also makes metals more expensive for overseas buyers. While Warsh has expressed support for aspects of Trump’s agenda, including potential rate cuts, markets do not view him as a strong advocate of aggressive monetary easing.

Investor caution has been visible in exchange-traded funds, with silver holdings falling for a seventh consecutive session to their lowest level since November 2025. Futures data show speculators reducing bullish positions sharply, indicating a broader retreat from the sector. ING analysts noted that managed money net longs in COMEX gold fell by nearly 18,000 lots last week, while silver positions also dropped to their lowest since February 2024.

Mechanical factors have amplified market stress. CME Group plans to raise margin requirements on COMEX gold and silver futures after last week’s swings, forcing traders to post more collateral or reduce exposure. “When a market has risen beyond fundamentals, it doesn’t take much to open the exit door,” Dewsnap said. “There aren’t enough buyers to absorb the selling cascade, which exacerbates the drop.”

Attention is turning to Asia, where Chinese investors traditionally support metals prices during dips. However, with volatility high and the Lunar New Year approaching, participation may be cautious. Analysts say short-term direction will depend on dip-buying from Chinese traders.

For now, the precious metals market remains fragile, closely watching US data for clues on real interest rates and dollar movements. Analysts warn that volatility is likely to remain elevated, with macro uncertainty and expectations around Fed policy continuing to dominate sentiment.

Business

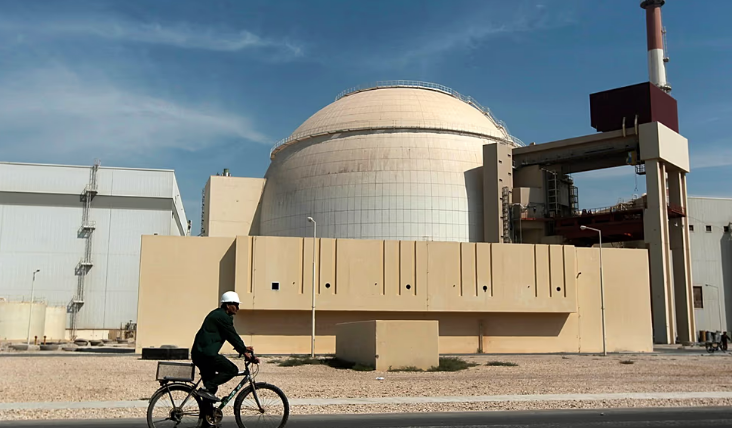

EU Imposes Fresh Sanctions on Iran While Trade Persists at Low Levels

The European Union has announced new sanctions on Iran, targeting human rights abuses and Tehran’s support for Russia’s full-scale invasion of Ukraine. Despite the restrictions, trade between the EU and Iran continues, though at significantly reduced levels. Germany remains Iran’s top trading partner within the bloc.

EU ministers approved the latest measures this week, part of a sanctions regime that dates back to the late 2000s. The EU first imposed sanctions on Iran in 2006 in line with UN Security Council demands, calling on the country to halt uranium enrichment and nuclear-related trade. Tighter measures followed in 2011 in response to ongoing human rights violations, and the sanctions have been renewed annually. The current framework is set to remain in place until April 2026.

Trade between the EU and Iran has not been completely halted. In 2024, the total value of goods traded reached €4.6 billion, according to Eurostat. EU exports accounted for €3.7 billion, while imports stood at €850 million, giving the bloc a trade surplus of roughly €2.9 billion. Trade in services also continued, with two-way flows totaling €1.68 billion in 2023, split between €870 million in exports and €800 million in imports.

Despite ongoing trade, Iran is a minor partner for the EU. In 2024, it represented just 0.1 percent of EU exports to non-EU countries, while its share of EU imports rounds to 0 percent. These figures mark a sharp decline from the mid-2000s, when Iran accounted for around 1 percent of EU trade. The value of trade peaked at over €27 billion in 2011, before falling sharply after sanctions tightened. A brief rebound occurred in 2017 following the 2015 nuclear deal, known as the Joint Comprehensive Plan of Action, but trade has remained close to €5 billion since 2019.

Germany plays a leading role in EU–Iran trade. In 2024, the country accounted for nearly a third of total trade between the EU and Iran. German exports to Iran reached €1.27 billion, while imports were €212 million. Italy followed with a 15.6 percent share, exporting €528 million and importing €185 million. The Netherlands accounted for 13.3 percent of trade, with exports of €607 million and imports of €62 million. Other notable EU partners included Belgium, Spain, France, and Bulgaria.

EU exports to Iran are dominated by machinery and transport equipment, which made up €1.28 billion or 34 percent of total exports in 2024. Chemicals and related products were another major category, at €1.13 billion or 31 percent. Imports from Iran were concentrated in food and live animals (€305 million), chemicals (€188 million), manufactured goods (€180 million), and crude materials excluding fuels (€89 million).

Trade with Iran is governed by the EU’s general import regime, as Tehran is not a member of the World Trade Organization and there is no bilateral trade agreement. While some EU countries, such as Sweden and Luxembourg, import slightly more than they export to Iran, overall trade remains limited and largely symbolic amid ongoing sanctions.

-

Entertainment1 year ago

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports1 year ago

Sports1 year agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1