News

European Markets Rebound as Asia Recovers from Sell-Off

European markets opened higher on Tuesday with Germany’s DAX, France’s CAC 40, and London’s FTSE 100 all showing gains after a significant sell-off on Monday.

Japan’s benchmark Nikkei 225 index soared nearly 11% on Tuesday, recovering from a sharp drop that had contributed to a global market slump on Monday. Other Asian markets also saw a rebound, though to a lesser extent, indicating a stabilization after the week’s turbulent start.

Monday’s market plunge was reminiscent of the 1987 crash, sparking fears of a slowing US economy. The Nikkei gained nearly 11% early Tuesday and was trading 10.3% higher by early afternoon as investors sought bargains after the previous day’s 12.4% drop. On Monday, the S&P 500 dropped 3%, marking its worst day in nearly two years, closing at 5,186.33. The Dow Jones Industrial Average fell by 1,033 points, or 2.6%, to 38,703.27, while the Nasdaq composite slid 3.4% to 16,200.08 as major tech companies like Apple and Nvidia experienced significant losses.

The global sell-off that began last week was further fueled by a report showing a slowdown in US hiring, raising concerns that the Federal Reserve’s prolonged high interest rates might be stifling the economy too severely. A report from the Institute for Supply Management on Monday showed slight growth in US services businesses, particularly in arts, entertainment, recreation, accommodations, and food services.

Professional investors cautioned that technical factors might have amplified the steep losses. South Korea’s Kospi index dropped 8.8% on Monday, and Bitcoin fell below $54,000 from over $61,000 on Friday. Even gold, typically a safe haven during market turmoil, slipped about 1%.

On Tuesday, nearly all Asian markets, except Singapore, saw gains. The Kospi jumped 4.3% to 2,546.64. Hong Kong’s Hang Seng index rose 0.5% to 16,775.65. Australia’s S&P/ASX 200 edged 0.3% higher to 7,677.50. Taiwan’s Taiex gained 1.2% after an 8.4% drop the day before. The Shanghai Composite index, which had largely bypassed Monday’s turmoil, was up slightly to 2,861.87.

The dramatic market moves reflect fears that the US economy might be harmed by the Federal Reserve’s high interest rates, leading to speculation about a possible emergency rate cut. The yield on the two-year Treasury, closely tied to Fed expectations, briefly sank below 3.70% on Monday before recovering to 3.89%.

“The Fed could ride in on a white horse to save the day with a big rate cut, but the case for an inter-meeting cut seems flimsy,” said Brian Jacobsen, chief economist at Annex Wealth Management, noting that such actions are usually reserved for emergencies.

Despite the recent declines, the US economy is still growing, and a recession is not certain. The stock market remains up significantly for the year, with double-digit gains for the S&P 500, Dow, and Nasdaq Composite.

Other factors contributing to Monday’s market plunge include the Bank of Japan’s recent interest rate hike, which led to a stronger yen and impacted global trading strategies. Big Tech companies, particularly those involved in artificial intelligence like Nvidia, saw sharp declines amid fears that their stock prices had risen too quickly.

In commodities, early Tuesday saw US benchmark crude oil up $1.18 to $74.12 per barrel, and Brent crude rising $1.00 to $77.30 per barrel. The euro edged up to $1.0956 from $1.0954.

As markets continue to react to economic data and global events, the path forward remains uncertain, but Tuesday’s gains suggest a temporary stabilization after a volatile start to the week.

News

Suspected Drone Strike Hits UK Base in Cyprus Amid Escalating Iran Conflict

News

Cruise Passengers Stranded Amid Escalating Middle East Crisis

The Persian Gulf is currently characterised by hostilities. The Strait of Hormuz is closed to shipping, with only vessels connected to China or Russia allowed to pass. The escalating crisis in the region has left thousands of tourists stranded on cruise ships and disrupted air travel.

On Sunday afternoon, a missile struck the water near the Mein Schiff 4, operated by TUI Cruises, while the ship was docked in Abu Dhabi, United Arab Emirates. Clouds of black smoke were reported over the water, according to the Bild newspaper. The vessel carries approximately 2,500 passengers and 1,000 crew members, with many due to return to Germany from Dubai. The situation on board is tense, and it is not yet clear if anyone was injured.

Security measures on the ship remain strict. Passengers are prohibited from entering outside decks, are advised to avoid windows, and receive regular alerts on their smartphones about potential incoming missile threats.

A sister ship, Mein Schiff 5, berthed in Doha, Qatar, is also affected. Passengers attempting to fly home from Doha on Saturday were forced to return to the ship after flights were canceled. Many had already boarded aircraft and had to leave luggage at the airport, waiting around ten hours before being taken back to the ship in the evening.

Other cruise lines are similarly affected. Six vessels are currently docked across ports in Dubai, Abu Dhabi, and Doha. These include the MSC Euribia from MSC Cruises, the Celestyal Discovery and Celestyal Journey from Celestyal Cruises, and the Aroya from the Saudi operator Aroya Cruises.

The closure of airspace in multiple countries in the region has compounded the situation, preventing passengers from flying home. Thousands remain stranded, unsure when they will be able to continue their journeys or be evacuated safely.

The crisis follows US and Israeli strikes in the region on Saturday, which prompted retaliatory attacks by Iran targeting military positions in the Persian Gulf. Cruise passengers, many of whom expected a calm holiday, have instead faced a sudden escalation in regional tensions.

Authorities in ports and embassies are coordinating with shipping companies to maintain safety and provide updates, but the rapidly evolving security situation has made evacuation and travel plans uncertain. Tourists are advised to follow official guidance and avoid unnecessary movement on or around their vessels.

The disruption highlights the wider impact of escalating hostilities in the Gulf, affecting not only commercial shipping but also tourism and international travel. Passengers on affected cruise ships and flights face prolonged delays as authorities work to stabilize the situation and ensure safety in the region.

News

Azerbaijan Commemorates Khojaly Massacre with New Memorial and National Ceremony

Azerbaijan held nationwide commemorations on Thursday to mourn the hundreds of civilians killed in February 1992 in the town of Khojaly during the Karabakh conflict with Armenia. President Ilham Aliyev led the ceremonies, inaugurating a new Khojaly Genocide Memorial Complex in Baku to honor the victims of what he described as “the greatest tragedy for the Azerbaijani people.”

Thousands of people gathered at the Khojaly Massacre Memorial in Baku for the National Day of Remembrance. A minute of silence was observed across the country as citizens paid tribute to those who lost their lives over 30 years ago.

Azerbaijani authorities state that 613 civilians, including women and children, were killed when Armenian forces, with the support of the former Soviet Union’s 366th Guards Motor Rifle Regiment, attacked Khojaly. Dozens more were reported missing or injured during the assault, which occurred amid the war between ethnic Armenian forces backed by Armenia and Azerbaijani troops over the Karabakh region and surrounding areas.

Human Rights Watch conducted its own investigation into the incident, attributing direct responsibility for the civilian deaths to Karabakh Armenian forces. Armenia has repeatedly denied the accusations, arguing that the reported death toll was exaggerated and that casualties resulted from fighting between the two sides.

Despite differing accounts, the Khojaly tragedy remains a deeply significant event in Azerbaijan’s collective memory. Commemorations continue to emphasize the human cost of the conflict and the impact on generations of Azerbaijanis.

This year’s ceremonies took place against the backdrop of a peace and reconciliation process between Azerbaijan and Armenia. Both nations have pledged to work toward a more stable and peaceful future following decades of conflict and suffering on both sides.

President Aliyev emphasized the importance of remembering the past while looking forward. The newly inaugurated memorial complex aims to provide a permanent site for reflection, ensuring that the victims of Khojaly are remembered by future generations.

The National Day of Remembrance has become a focal point for public reflection and national unity, drawing participants from across Azerbaijan. Observers note that the ceremonies serve both to honor the victims and to reinforce awareness of the historical and ongoing challenges in the Karabakh region.

Over 30 years after the massacre, Khojaly continues to hold a central place in Azerbaijani history. Thursday’s events highlighted the nation’s efforts to commemorate the past while supporting dialogue and cooperation with Armenia to foster lasting peace in the South Caucasus.

-

Entertainment2 years ago

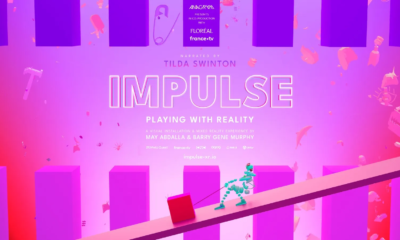

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1