Business

BHP Withdraws Bid for Anglo American, Clearing Path for Competitors and Restructuring Plans

Australian mining giant BHP has formally ended its pursuit of Anglo American, a move that closes the door on what would have been one of the decade’s most significant mining mergers. The decision follows preliminary talks and comes just weeks after Anglo American’s board rejected BHP’s latest offer, the company’s second approach in the past 18 months.

BHP said in a statement on Monday that it would no longer consider a combination of the two companies. “Following preliminary discussions with the Board of Anglo American, BHP confirms that it is no longer considering a combination of the two companies,” the company said. The miner highlighted the “highly compelling potential” of its own growth plans, signalling a strategic shift from ambitious acquisitions to organic expansion.

A successful BHP-Anglo merger would have created a dominant global copper producer, consolidating assets critical to electric vehicle and microchip industries. BHP said it still believed the deal had strong strategic merits and could generate value for stakeholders, but the challenges involved proved too significant.

Anglo American, founded in Johannesburg in 1917, operates across multiple jurisdictions, including regions where governments are particularly sensitive to control over strategic resources. BHP’s proposed merger required Anglo to conduct two separate demergers of its stakes in Anglo American Platinum and Kumba Iron Ore. The board described these demergers as introducing “significant uncertainty” for investors, noting that Anglo Platinum and Kumba together represent roughly $15 billion (€13 billion) and 34% of the proposed total consideration.

The rejection underscores the complexity of mega-deals in the mining sector. In recent years, BHP has preferred targeted acquisitions in potash and copper over large-scale mergers, reflecting growing investor caution around deals with heavy regulatory and operational hurdles. By emphasising the promise of its internal growth strategy, BHP appears to be prioritising stability and measured expansion over high-profile acquisitions.

Under Rule 2.8 of the UK Takeover Code, BHP is effectively barred from making another approach for at least six months unless circumstances change, such as board approval from Anglo American, the arrival of a rival bidder, or amendments to the Takeover Code.

The withdrawal opens the way for Anglo American to advance its own plans. Shareholders are expected to vote soon on a proposed merger with Canada’s Teck Resources, a deal that could create a company valued at over $50 billion (€43.3 billion). Meanwhile, other mining rivals are likely to reassess their options in the copper and broader resource markets.

BHP’s exit marks a significant moment in global mining, reflecting a shift from high-stakes consolidation to cautious, internally driven growth strategies as companies navigate complex regulatory and geopolitical landscapes.

Business

EU Household Energy Prices Remain Above Pre-War Levels Despite Stabilisation

Residential electricity and natural gas prices across the European Union remain higher than before Russia’s invasion of Ukraine, even though markets have steadied in recent years.

The war, which began in February 2022 and has now entered its fifth year, reshaped Europe’s energy landscape. According to the European Council, Russia’s share of EU pipeline gas imports fell sharply from around 40 per cent in 2021 to about 6 per cent in 2025, following sanctions, embargoes and efforts to diversify supplies.

New data from Eurostat show that between the first half of 2021 and the first half of 2025, household electricity prices in the EU rose 30 per cent, from 22 cents per kilowatt-hour to 28.7 cents. Over the same period, natural gas prices climbed 79 per cent, from 6.4 cents to 11.4 cents per kilowatt-hour.

The Household Energy Price Index (HEPI), compiled by Energie-Control Austria, MEKH and VaasaETT, tracks monthly end-user prices in European capital cities. Its January 2026 figures indicate that electricity prices across EU capitals were 5 per cent higher than in January 2022. However, compared with January 2021, prices were up 38 per cent.

Some cities experienced particularly sharp increases over the five-year period. Electricity prices more than doubled in Vilnius, rising 102 per cent. Other large jumps were recorded in Bucharest (88 per cent), Bern (86 per cent), Kyiv (77 per cent), Amsterdam (75 per cent), Riga (74 per cent), Brussels (67 per cent) and London (64 per cent).

Only Copenhagen and Budapest posted declines over that period, at minus 16 per cent and minus 8 per cent respectively.

Among the capitals of Europe’s five largest economies, London and Rome saw notable increases, while Madrid and Berlin recorded relatively modest rises. Paris remained below the EU average increase.

Energy analysts at the European Energy and Climate Policy (IEECP) say the electricity mix has been a decisive factor. Countries such as Spain benefit from a higher share of wind, solar and hydropower, while Nordic nations rely heavily on hydropower, geothermal and wind energy, reducing exposure to fossil fuel price swings.

Looking only at the period from January 2022 to January 2026 presents a different trend. Copenhagen recorded a 44 per cent fall in electricity prices, while London, Madrid, Berlin and Rome also saw declines. Paris, by contrast, registered a 21 per cent increase. Vilnius showed the largest EU rise at 70 per cent, while Kyiv topped the overall list at 87 per cent.

Natural gas prices across EU capitals edged down by 1 per cent between January 2022 and January 2026. Berlin, Brussels and Athens recorded declines of around 40 per cent, while Riga, Warsaw and Lisbon saw strong increases.

Despite the recent stabilisation, household energy bills across much of Europe remain well above pre-invasion levels, reflecting the lasting impact of the energy crisis.

Business

Transatlantic Tensions on Digital Rules Highlight Need for Cooperation

Discussions between Europe and the United States over digital regulation continue to be marked by miscommunication and frustration, even as competitors observe from the sidelines. Europeans and Americans talk past each other while rivals watch. The European Union can set its own standards, but in an interconnected economy, decoupling fantasies and grandstanding won’t help.

The debate often centres on “free speech” concerns voiced by U.S. tech companies and policymakers in response to the EU’s legislative framework for digital platforms. In Europe, such narratives typically prompt defensive reactions. Some Europeans respond with a blunt message: “This is our land, our Union, our laws, follow them, or leave the EU—we’ll find alternative products to use!” Public awareness of American constitutional amendments is low across Europe, just as Americans pay little attention to European digital acts and regulations.

The transatlantic dialogue is further complicated by the global nature of social media platforms. Any EU legislation affecting user experience inevitably influences the functioning of these platforms worldwide, touching on what Americans see as free speech rights. The EU also seeks to extend its influence through the “Brussels effect,” ensuring that European rules shape global standards, while the U.S. maintains a large trade surplus in services and competes technologically with China. This mix of economic, political, and regulatory factors explains why U.S. attention is sharply focused on Europe’s digital policies.

Europeans argue that their 450-million-consumer market has the right to set rules that reflect local principles and values. Attempts to adjust or simplify regulations are difficult, with efforts often met with political resistance and scrutiny. The regulatory ecosystem in Europe supports industries of lawyers, consultants, and experts whose work depends on maintaining complex rules, making reform a sensitive topic.

On the American side, anti-EU rhetoric by public figures has sometimes compounded the problem, drowning out moderates and reinforcing defensive European responses. Analysts note that both regions have seen productive voices sidelined as grandstanding and negative statements dominate public discourse.

Observers argue that long-term thinking is necessary. By evaluating the EU-U.S. tech partnership in the broader context of global alliances, including China and Russia, policymakers can better assess priorities and avoid unnecessary disruption. Blank-slate decoupling between Europe and the United States is unrealistic, and delaying constructive dialogue risks broader economic consequences.

Experts warn that continued transatlantic infighting benefits other global powers and weakens the ability of both regions to set coherent standards in emerging technologies. The message from analysts is clear: cooperation, not confrontation, will determine whether the EU and U.S. can maintain leadership in digital regulation while safeguarding economic and technological interests.

Business

Christine Lagarde’s Future at ECB Sparks Speculation Amid Reports of Early Departure

Reports on Wednesday suggested that Christine Lagarde could step down as president of the European Central Bank before her eight-year term officially ends in October 2027. An ECB spokesperson told Euronews that no decision has been made and emphasized that Lagarde remains focused on her mandate.

The central bank’s response was less categorical than last year, when similar rumours surfaced. The ECB previously stressed that Lagarde was “fully determined to complete her term,” but Wednesday’s statement offered a more measured tone.

The initial report, published by the Financial Times citing a source familiar with the matter, claimed that Lagarde may vacate her post ahead of the French elections in April 2027. Leaving the ECB before the vote would allow outgoing French President Emmanuel Macron and German Chancellor Friedrich Merz to influence the selection of her successor, potentially shaping the future of European monetary policy.

Macron is barred by the French constitution from seeking a third term, while polls show strong support for far-right candidates, including Marine Le Pen and her protégé Jordan Bardella. In Germany, the Alternative for Germany (AfD) party is gaining traction, raising concerns among Brussels and Paris officials that a Eurosceptic shift could complicate appointments to key EU institutions.

The speculation over Lagarde’s departure follows last week’s announcement that François Villeroy de Galhau, Governor of the Bank of France, would step down early. Speaking to a parliamentary committee, Villeroy de Galhau commented on the rumours about Lagarde: “I read a rumour about Lagarde, I discovered it, it doesn’t seem [like] information to me, I’ll leave it to the ECB to comment.”

Attention is now turning to potential successors in Frankfurt. An FT poll in December highlighted Klaas Knot, former governor of the Dutch central bank, and Pablo Hernández de Cos, former Bank of Spain governor, as leading candidates.

Knot is seen as a seasoned central banker who has shifted from a strict inflation-focused approach to a more moderate, consensus-driven stance. His profile appeals to Berlin, where Chancellor Merz may prefer a Dutch candidate over the potential complexities of appointing a German. Hernández de Cos, who currently heads the Bank for International Settlements, is regarded as a strong contender because of his technical expertise and reputation as a collaborative leader.

Observers suggest that the coming months could be decisive for the ECB, as political timing in France and Germany may influence the selection process. Analysts say the combination of rising far-right influence and strategic maneuvering by incumbent leaders could accelerate decisions about Lagarde’s replacement.

While the ECB stresses that no formal decision has been made, speculation over Lagarde’s future is likely to intensify, with European economists and policymakers closely monitoring developments that could reshape leadership at one of the continent’s most influential financial institutions.

-

Entertainment2 years ago

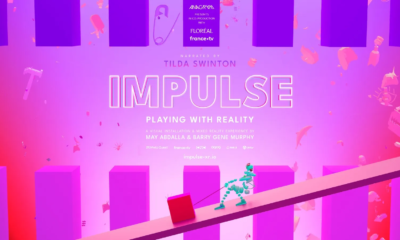

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1