News

European Markets Rebound as Asia Recovers from Sell-Off

European markets opened higher on Tuesday with Germany’s DAX, France’s CAC 40, and London’s FTSE 100 all showing gains after a significant sell-off on Monday.

Japan’s benchmark Nikkei 225 index soared nearly 11% on Tuesday, recovering from a sharp drop that had contributed to a global market slump on Monday. Other Asian markets also saw a rebound, though to a lesser extent, indicating a stabilization after the week’s turbulent start.

Monday’s market plunge was reminiscent of the 1987 crash, sparking fears of a slowing US economy. The Nikkei gained nearly 11% early Tuesday and was trading 10.3% higher by early afternoon as investors sought bargains after the previous day’s 12.4% drop. On Monday, the S&P 500 dropped 3%, marking its worst day in nearly two years, closing at 5,186.33. The Dow Jones Industrial Average fell by 1,033 points, or 2.6%, to 38,703.27, while the Nasdaq composite slid 3.4% to 16,200.08 as major tech companies like Apple and Nvidia experienced significant losses.

The global sell-off that began last week was further fueled by a report showing a slowdown in US hiring, raising concerns that the Federal Reserve’s prolonged high interest rates might be stifling the economy too severely. A report from the Institute for Supply Management on Monday showed slight growth in US services businesses, particularly in arts, entertainment, recreation, accommodations, and food services.

Professional investors cautioned that technical factors might have amplified the steep losses. South Korea’s Kospi index dropped 8.8% on Monday, and Bitcoin fell below $54,000 from over $61,000 on Friday. Even gold, typically a safe haven during market turmoil, slipped about 1%.

On Tuesday, nearly all Asian markets, except Singapore, saw gains. The Kospi jumped 4.3% to 2,546.64. Hong Kong’s Hang Seng index rose 0.5% to 16,775.65. Australia’s S&P/ASX 200 edged 0.3% higher to 7,677.50. Taiwan’s Taiex gained 1.2% after an 8.4% drop the day before. The Shanghai Composite index, which had largely bypassed Monday’s turmoil, was up slightly to 2,861.87.

The dramatic market moves reflect fears that the US economy might be harmed by the Federal Reserve’s high interest rates, leading to speculation about a possible emergency rate cut. The yield on the two-year Treasury, closely tied to Fed expectations, briefly sank below 3.70% on Monday before recovering to 3.89%.

“The Fed could ride in on a white horse to save the day with a big rate cut, but the case for an inter-meeting cut seems flimsy,” said Brian Jacobsen, chief economist at Annex Wealth Management, noting that such actions are usually reserved for emergencies.

Despite the recent declines, the US economy is still growing, and a recession is not certain. The stock market remains up significantly for the year, with double-digit gains for the S&P 500, Dow, and Nasdaq Composite.

Other factors contributing to Monday’s market plunge include the Bank of Japan’s recent interest rate hike, which led to a stronger yen and impacted global trading strategies. Big Tech companies, particularly those involved in artificial intelligence like Nvidia, saw sharp declines amid fears that their stock prices had risen too quickly.

In commodities, early Tuesday saw US benchmark crude oil up $1.18 to $74.12 per barrel, and Brent crude rising $1.00 to $77.30 per barrel. The euro edged up to $1.0956 from $1.0954.

As markets continue to react to economic data and global events, the path forward remains uncertain, but Tuesday’s gains suggest a temporary stabilization after a volatile start to the week.

News

Climate Concerns Rise Over Sponsorships at 2026 Winter Olympics

The 2026 Winter Olympics in northern Italy are facing mounting criticism over the environmental impact of their sponsorship deals, with scientists and athletes warning that the Games’ carbon footprint could threaten the future of winter sports.

A report by Scientists for Global Responsibility and the New Weather Institute, titled Olympics Torched, estimates that the Games themselves will produce around 930,000 tonnes of CO2 emissions. However, just three sponsorship agreements with major corporations could add 1.3 million tonnes more, more than doubling the total impact. The sponsors identified are oil and gas company Eni, car manufacturer Stellantis, and Italy’s national airline, ITA Airways, with Eni responsible for over half of the added emissions.

The report warns that the combined emissions could result in the loss of 5.5 square kilometres of snow cover in the Dolomites, equivalent to more than 3,000 Olympic-sized ice hockey rinks. Organisers have already announced plans to produce 2.4 million cubic metres of artificial snow for the Games, requiring 948,000 cubic metres of water, as warming temperatures continue to reduce natural snow and glaciers in the region.

“Even without the growing mountain of scientific evidence on the impact of global heating on winter sports, it is plain enough to anyone visiting actual mountains that snow cover is being lost and glaciers are melting,” said Stuart Parkinson, director of Scientists for Global Responsibility. He added that winter sports contribute directly to climate change through emissions and indirectly by promoting major polluters through sponsorship.

The report calls for urgent action, urging the Winter Olympics to end partnerships with high-carbon corporations, avoid new venue construction, and reduce spectator travel by air. Swedish cross-country skier Björn Sandström said the Games’ greatest influence is the signal they send to the world. “When that signal is driven by fossil-fuel sponsorship, it directly contradicts climate science and threatens the future of winter sport,” he said.

Greenlandic biathlete Ukalew Slettermark echoed the concern, arguing that giving oil companies a platform at the Games is unjustifiable. “It’s a complete contradiction when the fossil fuel industry, the biggest contributor to climate change, is allowed to sponsor winter sports, which they are simultaneously threatening,” she said.

The report also highlights broader environmental challenges in the Alps. Italy has lost 265 ski resorts in the past five years due to rising temperatures, and recent studies show mountain regions are warming faster than lowland areas, putting winter sports at risk.

The Milan-Cortina Olympics, spread across the Dolomites, have become a focal point for debates about climate responsibility in global sporting events. Critics say sponsorship deals with polluting corporations undermine efforts to promote sustainability and could damage the credibility of winter sports in a warming world.

Euronews Green has reached out to the International Olympic Committee for comment.

News

EU-Mercosur Trade Deal Signed Amid Rising Political Tensions in France

European leaders signed the EU-Mercosur trade deal on Saturday with Argentina, Brazil, Paraguay, and Uruguay, aiming to strengthen the bloc’s strategic and economic position. European Commission President Ursula von der Leyen called the agreement “25 years in the making” and described it as an “achievement of a generation” that prioritizes long-term partnerships over tariffs.

The deal, which would create a transatlantic free-trade zone, is seen by supporters as vital for countering China’s growing influence in Latin America. EU imports from Mercosur countries have fallen behind China’s share, reversing a trend seen in 2000 when the EU’s presence was six times larger. Advocates also argue the deal will diversify EU trade amid tighter US market access and growing reliance on Chinese materials and technology.

However, the agreement has exposed deep political divisions within the EU, with France emerging as the most vocal opponent. Paris voted against the deal in a key Council vote on 9 January, despite a majority of member states backing it. Critics in France argue the deal threatens domestic agriculture, exposing farmers to competition from Latin American imports that may not meet EU production standards.

The debate has intensified ahead of the European Parliament’s ratification process, scheduled to begin Monday. Lawmakers remain divided along national lines. France, Poland, Hungary, Ireland, and Austria opposed the deal, while Belgium abstained. In France, the issue has become a political flashpoint, feeding eurosceptic sentiment and prompting far-right Rassemblement National leader Jordan Bardella to launch a no-confidence motion in both the European Parliament and the National Assembly.

Supporters of the deal counter that France’s agricultural struggles are largely home-grown and point to concessions built into the agreement, including environmental safeguards, tariff-rate quotas for sensitive products such as beef and poultry, and a €45 billion support package for EU farmers from 2028. Despite these measures, Paris remains unconvinced, with President Emmanuel Macron noting that the deal would raise EU GDP by just 0.05% by 2040 and that tariff reductions on EU cars would be phased in over 18 years.

Other EU sectors stand to benefit from the agreement, particularly services, dairy, wine, spirits, and access to public procurement markets. Spanish MEP Javier Moreno Sánchez emphasized the deal’s importance in a “geopolitical and geo-economic context,” citing the need to negotiate on equal terms amid global trade tensions. German MEP Svenja Hahn highlighted that fears of agricultural disruption may be overstated, noting low utilization of quotas in similar deals like CETA.

After 25 years of negotiations, the Mercosur deal represents one of the EU’s most ambitious trade agreements. While supporters hope to build momentum for ratification in the European Parliament, opposition in France and a broader eurosceptic wave in parts of the bloc could complicate its implementation. Analysts warn that the deal’s political fallout may last longer than its economic impact, particularly in France, where public resistance to free-trade agreements runs deep.

News

New Tashkent Aims to Redefine Urban Living with Sustainability and Smart Infrastructure

Uzbekistan is moving forward with an ambitious plan to reshape its capital with the “New Tashkent” project, a purpose-built city designed to meet the demands of rapid population growth while promoting sustainability and modern urban living. Launched in March 2023 under Tashkent’s Master Plan through 2045, New Tashkent is planned to cover 20,000 hectares between the Chirchik and Korasuv rivers, positioning it as a major new urban hub rather than a suburban extension.

The city is expected to accommodate around 2 million residents and generate 200,000 high-income jobs driven by technology and innovation. It will feature smart-city innovations, modern amenities, and buildings built to international green standards, ensuring energy efficiency, climate resilience, and healthy living environments.

Urbanization pressures in Uzbekistan are mounting. By mid-2025, more than 19.3 million people, roughly 51 percent of the population, are projected to live in urban areas, compared with 18.6 million in rural regions. Tashkent itself officially has 3.1 million residents, but daily numbers may be 30–35 percent higher when including students and internal migrants. The concentration of 98 universities in the city continues to draw young people, intensifying demand for housing, transport, and social services.

Sustainability is central to New Tashkent’s design. Buildings will adhere to internationally recognised standards such as LEED, BREEAM, and EDGE, promoting energy efficiency, water conservation, and the use of sustainable materials. Green roof technology, rainwater collection systems, and other measures aim to reduce energy demand and improve resilience to climate extremes. The city’s energy infrastructure includes existing hydropower, a 400-megawatt solar farm, a new 100-megawatt solar installation, and a tri-generation facility converting waste into electricity and heat. Experts estimate that even modest efficiency gains could save over 900 million kilowatt-hours annually.

Transport planning is integral to the project. A 21-kilometre metro line will connect New Tashkent to the capital, while tram lines and eight multimodal transfer hubs will allow seamless switching between metro, tram, buses, bicycles, and scooters. The city is being designed around the 15-minute city concept, making walking, cycling, and public transport convenient for residents.

Urban planners are using a radial city model to prioritize walkability and access to services. Green infrastructure, parks, riverfronts, and cycling lanes will be integrated to create a connected, pedestrian-friendly environment. A cultural island at the intersection of artificial canals will serve as a social and recreational focal point, while the city’s waterways and green spaces will foster a comfortable microclimate.

By the end of 2025, construction had reached 3 million square metres. Several ministries have started operations from temporary facilities, and infrastructure projects include a €86 million underground parking facility with automated systems, bicycle rentals, and EV charging stations. Residential development includes the 95-hectare Sharq Bahori complex for 15,000 households, while New Uzbekistan University is being built to serve 10,000 students. A 55,000-seat FIFA-standard stadium is under construction ahead of the 2027 U-20 World Championship, which Uzbekistan will co-host with Azerbaijan.

New Tashkent is positioned as a blueprint for sustainable urban development in Central Asia, combining technology, green infrastructure, and strategic planning to support Uzbekistan’s rapidly growing urban population.

-

Entertainment1 year ago

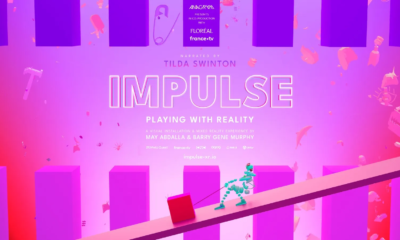

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports1 year ago

Sports1 year agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1