Latest

Wero Set to Challenge Visa and Mastercard as Europe’s First Sovereign Payment Solution

Wero, a new digital wallet launched under the European Payments Initiative (EPI), is poised to become Europe’s first sovereign payment solution and a key competitor to US giants Visa and Mastercard. With its rapid expansion across Germany, Belgium, and France, Wero aims to offer a strong alternative to the US-based payment networks, particularly within the European Single Market.

Backed by 16 European banks and two acquirers, including major players like BNP Paribas, Deutsche Bank, and Worldline, Wero is set to become a pan-European payment solution. The initiative aligns with the banking sector’s efforts to strengthen financial unity and independence within the continent.

In a statement from Brussels, EPI described Wero as “a European-grown player committed to offering a sovereign payment solution for all consumers on the continent.” EPI Chairman Dr. Joachim Schmalzl emphasized the significance of Wero’s launch, calling it a step toward enhancing Europe’s financial autonomy. “Our goal is to sustainably build this innovative solution, paving the way for a secure and efficient digital payment future in Europe,” Schmalzl added.

Wero’s Features and Expansion

The European Payments Initiative (EPI) acquired the e-commerce payment network iDeal in the Netherlands and the fintech company Payconiq International in Luxembourg, accelerating its ambitions. These acquisitions are aimed at establishing a unified instant payment platform across Europe.

Wero’s first service focuses on person-to-person transactions, allowing users to transfer funds in under 10 seconds using a phone number, email, or QR code—without requiring an IBAN. This operates like a direct debit between banks and is available 24/7 without extra fees.

Currently available in Germany, Belgium, and France, Wero provides users with real-time account balance and spending overviews, ensuring secure and convenient payment management. Plans for expansion include launching QR code-based online invoicing for small businesses in 2025 and in-store payment support in 2026. Future features will also include “buy now, pay later” options.

Competing with US Rivals

The development of Wero comes amid heightened European concerns about reliance on external payment systems, particularly following the suspension of Visa and Mastercard services in Russia in response to the 2022 invasion of Ukraine. This exposed vulnerabilities in Europe’s payment infrastructure, increasing the urgency for a homegrown alternative.

Wero’s instant payment capabilities, backed by major European banks, give it a strong foundation to compete with Visa, Mastercard, and PayPal. However, widespread consumer adoption and expansion into additional European markets will be crucial for success. Martina Weimert, CEO of EPI, described Wero as a “startup,” acknowledging that it faces significant challenges in reaching the level of competition posed by its US counterparts.

Despite these challenges, Wero’s emergence marks a significant step toward financial independence for Europe.

Latest

Flash Floods Devastate Thai Elephant Sanctuary, Killing Two Elephants and Forcing Evacuations

Latest

Severe Drought Causes Record Low Water Levels in Brazil’s Negro River

Latest

Oxford Scientists Develop First Ovarian Cancer Vaccine in Groundbreaking Research

-

Entertainment1 year ago

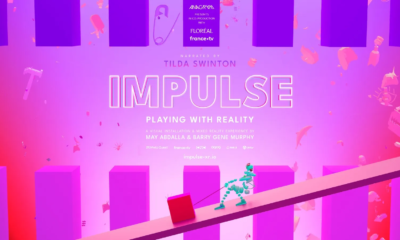

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports1 year ago

Sports1 year agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1