Business

South Korea Unveils $19 Billion Boost for Semiconductor Industry

Seoul, South Korea — President Yoon Suk Yeol has announced a groundbreaking $19 billion support plan aimed at fortifying South Korea’s vital semiconductor industry. As the global chip market continues to evolve, South Korea, home to memory chip giants Samsung Electronics and SK hynix, is positioning itself for a competitive edge. Here are the key highlights:

Comprehensive Support Program

- Financial Backing: The support program, valued at 26 trillion Korean won (approximately $19.1 billion), covers various aspects of the semiconductor industry.

- Encompassing Measures: It includes provisions for financial aid, infrastructure development, research and development, and targeted support for small and medium-sized enterprises.

- Earlier Investment: The package builds upon a $7 billion investment announced earlier this month.

![]()

Tax Benefits and Employment Boost

- Tax Incentives: President Yoon Suk Yeol revealed plans to extend tax benefits for chip investments.

- Employment Focus: The goal is to stimulate employment and attract talent to the semiconductor sector.

Mega Chip Cluster on the Horizon

- World’s Largest Complex: Just outside Seoul, South Korea is constructing a “mega chip cluster.”

- Job Creation: The government asserts that this complex will be the largest semiconductor-making facility globally, generating millions of jobs.

Semiconductors: A National Priority

- State-of-the-Art Race: President Yoon emphasized the critical nature of semiconductors as a “field of national all-out war.”

- Competitive Edge: Success hinges on producing state-of-the-art semiconductors with high information processing capabilities.

- Government Support: The state’s role is to ensure that South Korea remains at the forefront, avoiding any lag behind global competitors.

New Financial Support Program

- Crucial Investments: Yoon Suk Yeol announced a “new semiconductor financial support program” worth 17 trillion won ($12.5 billion).

- Korea Development Bank: This program, administered through the Korea Development Bank, will facilitate essential investments by companies.

South Korea’s strategic vision and substantial investment underscore its commitment to maintaining leadership in the semiconductor industry.

Business

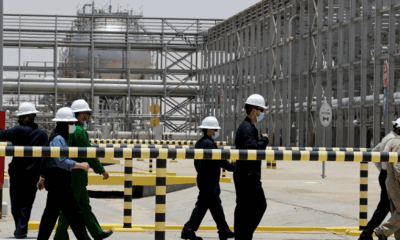

Saudi Aramco Profits Dip Amid Falling Oil Prices as Kingdom Commits Massive US Investments

Saudi Arabia’s oil giant Aramco reported a 4.6% drop in first-quarter profits on Sunday, amid declining global oil prices and growing financial pressure to meet the kingdom’s ambitious development goals, including massive investments in the United States.

Aramco, the world’s largest oil producer, posted a net income of $26 billion (€23.4 billion) for the first quarter of 2025, down from $27.2 billion (€24.5 billion) during the same period last year. Quarterly revenues came in at $108.1 billion (€97.4 billion), slightly up from $107.2 billion (€96.5 billion) a year earlier, according to a filing on the Tadawul stock exchange in Riyadh.

The dip in earnings comes as global energy markets remain volatile. Brent crude, the international oil benchmark, recently traded at just over $63 (€56.7) a barrel—down from peaks of over $80 (€72) last year. Aramco’s stock, which once traded at highs near $8 (€7.2), has also slipped in recent months, closing Sunday at just over $6 (€5.4) per share.

Aramco CEO Amin H. Nasser acknowledged the challenges in a statement, saying “global trade dynamics affected energy markets in the first quarter of 2025, with economic uncertainty impacting oil prices.”

Meanwhile, Saudi Arabia has pledged to invest $600 billion (€540.2 billion) in the United States during President Donald Trump’s second term. Trump, expected to arrive in Riyadh on Tuesday for his first official overseas trip since returning to office, has publicly called for that figure to reach $1 trillion (€900 billion).

The investment pledge coincides with Crown Prince Mohammed bin Salman’s ambitious domestic agenda. Central to those plans is Neom—a $500 billion (€450.1 billion) futuristic megacity being developed along the Red Sea—and preparations for hosting the 2034 FIFA World Cup, which will require tens of billions of dollars in infrastructure spending.

To help fund these initiatives, Saudi Arabia may have to dip into its sovereign reserves or increase borrowing, especially as oil revenues come under pressure. The recent decision by the OPEC+ alliance to increase oil production by 411,000 barrels per day next month is expected to complicate efforts to stabilize prices.

Aramco remains one of the world’s most valuable companies, with a market capitalization exceeding $1.6 trillion (€1.4 trillion), trailing only a handful of U.S. tech giants. While a portion of its shares trade publicly, the majority is held by the Saudi government, providing a crucial financial pillar for state-led development and the royal family’s wealth.

Would you like a version of this article tailored for an international business audience?

Business

Eastern Europe Leads in Real Wage Growth in 2024, Turkey Tops the Chart

Business

Expert Tips on Building a Solid UK Pension Plan Amid Rising Costs

As the cost of living in the UK continues to rise, many Brits are finding it harder to save for retirement. However, with life expectancies also increasing, experts warn that starting a pension plan as early as possible is more important than ever. A recent YouGov survey revealed that 38% of UK residents aren’t saving for retirement, with only 28% contributing up to 10% of their income.

To help navigate the complexities of retirement savings, Euronews reached out to financial experts for their top tips on building a solid pension plan.

Start Early and Save More

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, stresses the importance of saving as much as possible, as early as possible. She suggests that the earlier you start contributing to your pension, the more your investments can grow over time. A simple but effective strategy is to increase contributions every time you receive a pay raise. “You’re not used to having that extra money, so it’s easier to allocate it to your pension,” Morrissey explains.

Negotiate with Your Employer

For those enrolled in workplace pension schemes, Morrissey advises negotiating higher contributions. By default, UK employers must contribute at least 3% of employees’ salaries into pension pots, with employees contributing 5%. Some employers offer more generous contributions, sometimes matching what employees put in. Another option is a salary sacrifice scheme, where employees can reduce their salary and have the equivalent amount paid directly into their pension, benefiting from tax reductions.

Stay Engaged and Monitor Your Investments

Claire Trott, divisional director of retirement & holistic planning at SJP, emphasizes the importance of regularly checking your pension progress. “At least once a year, assess how much you’ve saved and determine if it will be sufficient for retirement,” she advises. Additionally, it’s essential to review where your contributions are being invested. Workplace pension schemes often place contributions into default funds that may not always be the most beneficial for your individual needs.

Consider Alternative Savings Products

In addition to pensions, Lucie Spencer from Evelyn Partners suggests utilizing tax-free ISAs (Individual Savings Accounts) to complement pension savings. Although contributions to ISAs are made from after-tax income, the funds grow tax-free, making them an ideal option for retirement savings.

Be Cautious About Early Withdrawals

While it’s tempting to access pension funds early, experts recommend against this unless absolutely necessary. Early withdrawals reduce the time for investments to grow and may push individuals into higher tax bands if they continue to earn income. The state pension can typically be accessed at age 66, with private pensions available at age 55 (rising to 57 in 2028).

Consolidate Pension Pots

For those who switch jobs frequently, pension pots can become fragmented. Claire Trott advises consolidating multiple pension pots into one to simplify management and reduce administrative hassle. However, it’s important to consider that older pension schemes, particularly those before 2006, may offer better benefits than more recent ones.

Utilize “Carry Forward” Rules

The “carry forward” rule allows individuals to top up their pensions by using unused tax relief from the last three years. For example, high earners can make significant contributions to their pensions, sometimes up to £220,000, if they have unused allowances from previous years.

Don’t Overlook the State Pension

Finally, experts stress the importance of keeping track of your state pension entitlement. To receive the full state pension, individuals need 35 qualifying years of National Insurance contributions. Though state pensions don’t require as much management as workplace or private pensions, they provide a guaranteed income for life, making them a crucial part of retirement planning.

By following these expert tips, UK residents can ensure they are better prepared for retirement, no matter the challenges ahead.

-

Business12 months ago

Business12 months agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business12 months ago

Business12 months agoRecent Developments in Small Business Taxes

-

Politics12 months ago

Politics12 months agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business10 months ago

Business10 months agoCarrectly: Revolutionizing Car Care in Chicago

-

Business11 months ago

Business11 months agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1

-

Technology12 months ago

Technology12 months agoComparing Apple Vision Pro and Meta Quest 3

-

Politics12 months ago

Politics12 months agoIndonesia and Malaysia Call for Israel’s Compliance with ICJ Ruling on Gaza Offensive

-

Sports9 months ago

Sports9 months agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m