Business

China Vows to ‘Fight to the End’ as Trump’s 104% Tariffs Take Effect

China has issued a firm warning that it will not back down in the face of escalating trade tensions with the United States, vowing to “fight to the end” against sweeping new tariffs imposed by former U.S. President Donald Trump. In a strongly worded policy statement published on Wednesday, the Chinese Ministry of Commerce accused Washington of breaking past trade promises and warned of severe consequences for both economies.

The statement came as Trump’s 104% tariffs on Chinese goods officially came into effect, targeting a wide array of exports and deepening a growing economic rift between the world’s two largest economies. The Chinese government responded by reiterating its commitment to retaliate with a robust package of countermeasures, including 34% tariffs on all U.S. imports, restrictions on rare earth mineral exports, and other targeted economic actions.

“If the U.S. insists on further escalating its economic and trade restrictions, China has the firm will and abundant means to take necessary countermeasures and fight to the end,” the Ministry of Commerce said in the white paper released Wednesday morning.

Unlike other nations currently negotiating exemptions or modifications to Trump’s tariff regime, China has thus far declined to engage in formal talks. Ministry of Foreign Affairs spokesman Lin Jian stated that dialogue was only possible under conditions of “equality, respect, and mutual benefit.”

Tensions have been further exacerbated by the U.S. move to potentially ban TikTok unless it is sold to an American buyer — a move Beijing claims violates previous agreements made in the Phase 1 trade deal signed during Trump’s first term. That agreement included provisions to avoid pressuring companies into forced technology transfers. China now says the proposed TikTok ban breaches those commitments.

While ByteDance, TikTok’s parent company, has attempted to reopen discussions, China has reportedly blocked progress on the deal until broader trade and tariff issues are addressed.

In an effort to counter U.S. claims of trade imbalance, China’s policy paper argues that overall economic exchange — when including services and the operations of U.S. companies within China — is effectively balanced. In 2023, China recorded a $26.57 billion trade in services deficit with the U.S., covering industries such as insurance, banking, and accounting.

The ministry also dismissed the logic behind Trump’s tariff strategy, warning of broader economic consequences for the U.S. itself. “History and facts have proven that the United States’ increase in tariffs will not solve its own problems,” the statement read. “Instead, it will trigger sharp fluctuations in financial markets, increase inflation, weaken industrial competitiveness, and raise the risk of recession — ultimately backfiring on itself.”

The standoff shows no signs of resolution, and with both sides escalating rather than easing tensions, global markets are bracing for further fallout in the weeks ahead.

Business

Commerzbank Delivers Strongest Quarterly Results in Over a Decade Amid Takeover Tensions

Germany’s Commerzbank has reported its highest quarterly profit since 2011, beating market expectations and reinforcing its position as it fends off takeover efforts by Italy’s UniCredit.

For the first quarter of 2025, Commerzbank posted a 12% increase in net income, reaching €834 million, defying earlier forecasts of a decline. Revenues also climbed 12% year-on-year to €3.1 billion, while net commission income rose by 6% to €1 billion, bolstered by a robust performance in its securities business. However, net interest income declined slightly to €2.07 billion amid falling interest rates.

Chief Executive Bettina Orlopp hailed the performance as a sign of strength despite challenging economic conditions. “We achieved the highest quarterly profit since 2011, demonstrating that we can grow even in economically challenging times,” she said. “We are progressing with the implementation of our strategy ‘Momentum’. We plan to return more capital to our shareholders in the coming years.”

The bank recently concluded a €1 billion share buyback programme launched in November 2024 and plans to propose a dividend of €0.65 per share at its Annual General Meeting on May 15.

These positive results come at a critical juncture, as Commerzbank seeks to resist UniCredit’s takeover push. The Italian lender has increased its stake to 29.9%, just below the 30% threshold that would trigger a mandatory public offer. In response, Commerzbank has launched cost-cutting initiatives, including plans to reduce its workforce by 10% — a move currently under negotiation with employee representatives.

Union-led protests against a potential takeover are also scheduled to take place ahead of the AGM, highlighting growing internal resistance.

Despite the corporate unrest, the bank reaffirmed its 2025 targets, projecting a full-year net profit of approximately €2.4 billion after restructuring expenses. €40 million has already been set aside this quarter for early retirement schemes as part of the broader cost-reduction plan.

The lender also noted progress in its efforts to reduce reliance on interest income as rates fall, with return on tangible equity rising to 11.1% from 10.5% in the same quarter last year.

CFO Carsten Schmitt confirmed the bank is on course to meet its full-year equity return target of around 9.6%. “We are reducing our dependency on net interest income. We confirm our outlook for 2025,” he said.

As pressure mounts from both markets and potential acquirers, Commerzbank’s performance could prove pivotal in maintaining its independence.

Business

UK’s Highest and Lowest Paying Jobs Revealed in Latest ONS Report

The UK’s salary landscape continues to evolve, with new figures from the Office for National Statistics (ONS) revealing a significant divide between the highest and lowest paying professions. The annual data, based on April 2024 earnings, highlights growing income disparities and changing trends across sectors.

According to the ONS, the median gross annual earnings for full-time employees reached £37,430 in April 2024 — a 6.9% increase from the previous year. But while average pay is rising, the gap between the top and bottom earners remains stark.

Leadership, Tech, and Transport Dominate Top Salaries

Unsurprisingly, executive and leadership roles lead the list of the UK’s highest paying jobs. Chief executives and senior officials top the chart with a median annual salary of £88,056. Close behind are directors in marketing, sales, and advertising (£87,309), and IT directors (£86,033). These three are the only professions with salaries surpassing €100,000 annually.

Notably, aircraft pilots and air traffic controllers rank fourth (£80,414), followed by specialist medical practitioners (£74,979) and headteachers (£71,064). Several transport-related roles also feature prominently — including train and tram drivers, who earn £63,958, outpacing even judges and barristers (£59,423).

Tech remains a stronghold for high pay, with various IT roles — such as systems designers, software developers, and business analysts — earning well above the national median. Other well-compensated fields include engineering, statistics, and emergency services. Paramedics, for instance, earn an average of £54,638, while aerospace and electronics engineers earn just over £52,000.

The 40th highest-paying job still earns £50,853, illustrating the significant financial gap even within the top-earning group.

Hospitality, Childcare, and Support Roles Trail Behind

At the opposite end of the spectrum, school midday supervisors and crossing patrol staff are the lowest paid in the UK, earning £19,860 — just over half the national median. Coffee shop workers follow closely at £19,990.

Hospitality and catering roles dominate the bottom 40, with bar staff, waiters, cooks, and kitchen assistants all earning between £20,000 and £23,000. Despite their societal importance, early years and childcare professionals are also among the lowest paid. Childminders earn around £20,189, while early education assistants make under £23,000 annually.

Manual and cleaning roles, such as launderers, florists, and sewing machinists, also rank low. Even some healthcare support roles, including dental nurses and pharmacy assistants, fall below the national median despite requiring training or certification.

As the UK’s job market evolves, this data underscores the persistent inequality in pay across sectors. While digital and technical roles continue to gain value, critical support and care professions lag behind, raising important questions about how society rewards its workforce.

Business

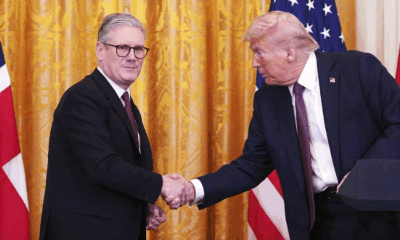

UK and US Poised to Announce New Trade Deal Amid Tariff Tensions

The United Kingdom and the United States are expected to announce a new trade agreement later today, following comments from U.S. President Donald Trump that a deal with a “highly respected” country was imminent. Downing Street confirmed Thursday morning that a formal statement would be issued, highlighting deepening economic ties between the two transatlantic allies.

According to a spokesperson for Prime Minister Keir Starmer, the pending agreement reflects Britain’s commitment to acting in the national interest. “The prime minister will always act in Britain’s national interest – for workers, for business, for families,” the spokesperson said. “The United States is an indispensable ally for both our economic and national security. Talks on a deal between our countries have been continuing at pace and the prime minister will update later today.”

The anticipated deal could mark the first formal trade agreement reached by the U.S. since “Liberation Day” in April, when President Trump introduced a new wave of tariffs targeting foreign imports. The UK emerged relatively unscathed from those tariffs, with its exports facing a 10% baseline duty—far less than the 20% rate imposed on EU goods or the 30%-plus levies on imports from several Asian countries.

However, key British exports such as cars and steel are still subject to a 25% tariff under current U.S. rules. Trade experts anticipate that the forthcoming agreement will focus on easing restrictions in these sectors, though it is unlikely to extend to a full-scale free trade arrangement at this stage.

British negotiators have been in Washington this week in a final push to secure more favorable terms, amid growing concern over potential future levies. President Trump’s recent proposal to tax foreign films has also raised alarms in the UK, where the film industry is a major source of export revenue.

The UK is also broadening its global trade strategy. On Tuesday, Prime Minister Starmer announced a long-awaited trade deal with India, easing the movement of professionals and reducing tariffs on British gin and whisky. Meanwhile, preparations are underway for a UK-EU summit on May 19, where discussions are expected to include a post-Brexit youth mobility agreement.

The U.S., for its part, is exploring deals with several nations including Japan, Israel, and India, though negotiations with China remain strained. President Trump has signaled that he will not lower tariffs on Chinese imports—currently at 145%—without significant concessions from Beijing.

As transatlantic talks reach their conclusion, today’s announcement could mark a significant milestone in reshaping post-Brexit trade relations between London and Washington.

-

Business12 months ago

Business12 months agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business12 months ago

Business12 months agoRecent Developments in Small Business Taxes

-

Politics12 months ago

Politics12 months agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business10 months ago

Business10 months agoCarrectly: Revolutionizing Car Care in Chicago

-

Business10 months ago

Business10 months agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1

-

Technology12 months ago

Technology12 months agoComparing Apple Vision Pro and Meta Quest 3

-

Politics12 months ago

Politics12 months agoIndonesia and Malaysia Call for Israel’s Compliance with ICJ Ruling on Gaza Offensive

-

Technology12 months ago

Technology12 months agoRecent Developments in AI Ethics in America