Business

UniCredit Threatens to Abandon €10 Billion Takeover of Banco BPM Amid Escalating Tensions

UniCredit, Italy’s largest bank, has warned that it will walk away from its proposed €10 billion acquisition of Banco BPM if the smaller bank proceeds with an increased bid to acquire Anima Holding SpA. The takeover battle, which has intensified in recent weeks, has led to a public war of words between UniCredit CEO Andrea Orcel and Banco BPM CEO Giuseppe Castagna.

UniCredit’s Countermove

UniCredit originally made its €10 billion takeover offer for Banco BPM in November 2024, shortly after Banco BPM made a €1 billion bid to acquire Anima Holding, an asset management firm. Banco BPM sought to boost its asset management fee income as interest rates declined.

However, UniCredit’s bid has complicated Banco BPM’s ability to finalize its offer for Anima, as Italian regulations prevent a bank that is the target of a takeover from pursuing its own acquisitions without shareholder approval.

Banco BPM’s shareholders are set to vote on February 28 to decide whether to increase their offer for Anima from €6.2 per share to €7 per share. If successful, Banco BPM’s market valuation would rise above €13 billion, exceeding UniCredit’s acquisition offer.

Orcel has made it clear that UniCredit will not overpay for Banco BPM and has hinted that he may withdraw the takeover offer altogether if Banco BPM’s bid for Anima moves forward.

Regulatory Hurdles and Financial Risks

To proceed with the Anima acquisition, Banco BPM would need to secure regulatory approval for favorable capital treatment, known as the Danish Compromise. However, this would require a lengthy approval process from the European Central Bank (ECB).

UniCredit has argued that if Banco BPM’s shareholders approve the increased bid for Anima, the bank’s CET1 capital ratio could decline by approximately 268 basis points, adding significant financial strain.

In a strongly worded statement, UniCredit said:

“In case the Offer were 100% successful and the Danish Compromise not granted, BPM’s CET1 ratio would decline by approximately 268bps, adding to the financial burden of an increased consideration.”

Escalating Tensions Between Bank CEOs

Banco BPM’s CEO Giuseppe Castagna has fired back at UniCredit’s claims, calling them “very dangerous” and “fake news.”

In an interview, Castagna accused Orcel of trying to manipulate Banco BPM’s stock price and influence the shareholder vote. He stated:

“The allegations that we are not going to get the Danish Compromise is completely fake news. The guy is trying to play a game. He wants to depress our stock in favor of his own stock. We will respond legally to these kinds of allegations.”

If Banco BPM secures shareholder approval for its increased bid, two major Anima investors—Poste Italiane and private equity fund FSI—have already indicated they will sell their stakes to Banco BPM, according to Reuters.

UniCredit’s Final Warning

Despite the mounting tensions, UniCredit emphasized that it has not yet made a final decision on whether to withdraw its offer.

In its statement, the bank said:

“Notice of the above is given to the public to ensure that BPM shareholders can make their own decisions in full awareness of the risks and uncertainties underlying the proposals that have been made to them and the possible consequences of their decisions.”

With the shareholder vote just weeks away, the fate of both Banco BPM’s bid for Anima and UniCredit’s takeover offer remains uncertain.

Business

Iran’s Strikes Across Gulf and Azerbaijan Disrupt Global Energy Markets

Iran’s apparent erratic strikes all over the Gulf and now Azerbaijan, together with its stranglehold of the vital Strait of Hormuz, have resulted in a growing strain on the world’s global energy supplies with incalculable consequences ahead. During the US-Israeli military buildup preceding the war that erupted one week ago, Iran repeatedly warned it would retaliate if attacked, promising widespread disruption.

Since the conflict began last Saturday, Tehran has expanded its aerial campaign across the Gulf and, on Thursday, extended attacks to Azerbaijan. While Iranian officials claim the strikes target only US and Israeli interests, missiles and drones have also hit the Gulf’s energy infrastructure, essential to global supply chains, and disrupted shipping lanes in the Strait of Hormuz, where roughly 20% of the world’s oil passes. Lloyd’s List reported that more than 200 ships remain stranded due to restricted movement in the strait.

Qatar halted liquefied natural gas (LNG) production at its top facilities in Mesaieed and Ras Laffan Industrial City after drone attacks, sending shockwaves through global energy markets. Qatar’s LNG supplies account for around 20% of the world’s total and play a key role in balancing demand across Asia and Europe. Iranian strikes also forced Saudi Arabia’s largest oil refinery to suspend operations, while Iraqi oil production and Israeli gas fields suffered disruptions. Dubai’s ports, among the world’s busiest, were reportedly impacted as well.

The UK Foreign Office said Friday that while the tempo of Iranian missile and drone strikes has slowed since the war’s early days, their focus is increasingly on economic and energy targets. In an interview with the Financial Times, Qatar’s Energy Minister Saad al-Kaabi warned the conflict “could bring down the economies of the world,” adding that continued hostilities would push energy prices higher and trigger shortages affecting industries worldwide.

Experts highlight the potential for a wider economic impact if the Strait of Hormuz remains blocked. Dr. Yousef Alshammari, president of the London College of Energy Economics, told Euronews that such a blockade “could trigger a global recession if it continues,” citing potential political pressure from China, a major consumer of Iranian oil.

Former US ambassador to Azerbaijan Matthew Bryza criticized Iran’s attack on Azerbaijan as lacking strategic logic, noting that Tehran’s actions “don’t make much sense in terms of a coherent, rational military plan.” Bryza suggested that some strikes may reflect decisions by lower-level commanders following directives from Iran’s supreme leader to delegate military authority if senior officials were killed, rather than a coordinated strategy.

The ongoing strikes have caused oil and gas prices to surge, with European gas already up more than 50%, and global markets remain on high alert. Analysts warn that disruptions could escalate further, amplifying the economic toll and keeping international energy markets under pressure as the conflict continues.

Business

Prolonged Iran Conflict Could Weaken Euro and Trigger Recession, Economists Warn

Economists are warning that the ongoing war in Iran could have severe consequences for the euro and the European economy if the conflict continues beyond the “four weeks” projected by former US President Donald Trump. The hostilities, which began at the end of February, have already triggered an energy price shock, affecting oil, petrol, diesel, and gas. Rising energy costs are hitting consumers and energy-intensive industries such as chemicals and steel, putting additional pressure on the German economy, which was already facing modest growth forecasts.

The euro, currently trading around $1.16, is under particular pressure. Economist Daniel Stelter warned that an extended conflict would further weaken a euro already affected by low growth, high debt, and political uncertainty. “Capital would flow into dollar investments considered safe,” he said. Carsten Brzeski, chief economist at ING Bank, added that if the conflict disrupts oil supplies through the Strait of Hormuz for several weeks, oil prices could exceed $100 per barrel, pushing the euro down to $1.10–$1.12 per dollar. This would represent a 5–8 percent drop, the lowest levels since the 2022–23 energy crisis triggered by the Ukraine war.

Such a decline would make holidays in the US more expensive for Europeans and increase the cost of imports such as oil, electronics, and raw materials. Stelter warned of even more severe scenarios, suggesting that the euro could temporarily fall below parity with the dollar, reaching $0.90–$0.95, if the war leads to prolonged regional instability.

Germany could face particularly serious economic consequences. Stelter said higher energy prices act like an additional tax, reducing consumption and investment. In a prolonged blockade scenario, Germany could fall into a deep recession, with the wider eurozone at risk of at least a technical recession. Extended disruptions would also strain bond markets and interest rates, potentially forcing the European Central Bank (ECB) to intervene more aggressively to prevent a debt crisis.

The war’s impact on global energy supplies could trigger an “energy black swan,” causing sudden shortages and price spikes that ripple through the global economy. German exports could collapse despite a weaker euro if higher energy prices reduce demand in major markets such as China, India, and the US.

The ECB faces a complex challenge: if the conflict is short-lived, it could lower interest rates to support growth. If the war drags on, inflationary pressures from energy prices would limit the bank’s ability to cut rates, leaving the euro under pressure and economic momentum stalled. Stelter said this scenario could lead to stagflation, with rising inflation and falling growth simultaneously.

A rapid end to hostilities within four to five weeks and minimal damage to critical energy infrastructure in Saudi Arabia and Qatar could help stabilize the euro. However, resistance from Iran’s leadership raises the risk of a prolonged conflict with serious economic implications for Europe.

Business

European Gas Prices Jump as Middle East Tensions Rattle LNG Markets

Gas prices in Europe surged on Tuesday as escalating tensions in the Middle East disrupted global energy flows and raised fears of tighter liquefied natural gas supplies, increasing concerns about the region’s fragile energy recovery.

Europe’s benchmark Dutch TTF gas contract climbed above €60 per megawatt hour around 12:30 CET, a sharp rise from the low €30s recorded at the end of last week. The spike followed US and Israeli strikes on Iran, which unsettled global markets and renewed anxiety about potential supply disruptions.

“This has triggered immediate fears of reduced LNG availability to Europe, prompting a rush in spot markets and heightened risk premiums,” said Yousef M. Alshammari, president of the London College of Energy Economics.

Traders are closely watching LNG shipments from Qatar and maritime traffic through the Strait of Hormuz, a key chokepoint for global energy trade. Any disruption to flows through the strait could tighten supply and intensify competition for cargoes, particularly between Europe and Asian buyers.

Europe has reduced its reliance on Russian pipeline gas since Moscow’s invasion of Ukraine, replacing much of that supply with seaborne LNG. While this shift has improved diversification, it has also increased dependence on global shipping routes and spot market cargoes, both of which can become volatile during geopolitical crises.

Qatar accounts for an estimated 12 to 14 percent of Europe’s LNG imports, making developments in the Gulf region particularly significant. Analysts at Brussels-based think tank Bruegel said that even though Europe is less dependent on Gulf oil and LNG than major Asian economies, it remains exposed to global price swings.

Gas storage levels add to the concern. European Union storage facilities are around 30 percent full, lower than at the same point last year. Germany’s inventories stood at about 21.6 percent in late February, with France also reporting levels in the low 20s. Lower reserves could complicate efforts to rebuild stocks ahead of next winter if high prices persist.

Alshammari warned that a prolonged period of elevated wholesale prices could eventually filter through to households and businesses. While many consumers are protected by fixed or regulated tariffs that adjust gradually, sustained prices above €50–60 per megawatt hour could push up electricity and heating bills in the coming months.

Energy-intensive industries such as chemicals, fertilisers, steel, glass and paper manufacturing are likely to face renewed cost pressures. Countries including Germany, Italy and the Netherlands could see competitiveness affected if prices remain high.

Lower-income households in Central and Eastern Europe, as well as parts of southern Europe, may also be vulnerable due to greater reliance on gas for heating and less energy-efficient housing. Governments may need to consider targeted measures if the current disruptions continue and market volatility persists.

-

Entertainment2 years ago

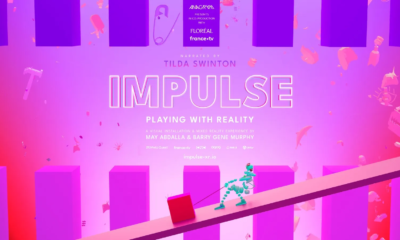

Entertainment2 years agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports2 years ago

Sports2 years agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1