News

Tel Aviv-Based Cybersecurity Firm Dream Secures $100 Million in Funding, Valuation Hits $1.1 Billion

Israeli cybersecurity firm Dream has raised $100 million (€105 million) in a Series B funding round, bringing its valuation to $1.1 billion (€1.05 billion). The company, which specializes in AI-driven cyber defense solutions for governments, aims to detect and neutralize cyber threats before they materialize.

The funding round, announced on Monday, was led by Bain Capital Ventures, with additional backing from Group 11, Tru Arrow, Tau Capital, and Aleph. The fresh capital injection will accelerate the company’s expansion into new markets and enhance the development of its Cyber Language Model (CLM), a next-generation AI tool designed to counter evolving cyber threats.

Cybersecurity in an Age of Increasing Threats

Founded in January 2023, Dream has quickly established itself as a key player in the cybersecurity sector, particularly in government and national security contracts. In 2024 alone, the company generated more than $130 million (€124 million) in sales to governments and national cybersecurity organizations.

Sebastian Kurz, co-founder and President of Dream, emphasized the urgency of robust cyber defense strategies.

“Sophisticated cyber-attacks on critical infrastructure are increasing in both prevalence and complexity,” Kurz said in a statement.

“During my time as Prime Minister, I saw firsthand how these attacks can cause real human damage and have the potential to disrupt entire societies. By founding Dream, we are on a mission to empower nations against what I believe is the defining national security threat of our era.”

Kurz, the former Austrian Chancellor, founded Dream alongside entrepreneur Shalev Hulio and cyber expert Gil Dolev. The venture marks a major shift in Kurz’s career, following his resignation from government in 2021 amid corruption allegations.

A New Chapter for Sebastian Kurz

Kurz stepped down as Austria’s Chancellor in 2021 after facing accusations of misusing public funds for favorable media coverage. In February 2024, he was found guilty of lying under oath to parliament and received an eight-month suspended sentence. Kurz has called the ruling “very unfair” and has since launched an appeal.

Despite his controversial political exit, Kurz has rebranded himself in the tech and cybersecurity industry, leveraging his experience in governance to address national security threats in the digital age.

The Growing Demand for AI-Driven Cyber Defense

With cybercriminals increasingly deploying AI-powered attacks, experts stress that AI-based defenses are essential to counter deepfake scams, phishing campaigns, and sophisticated cyber espionage.

According to industry data cited by the World Economic Forum (WEF), the total cost of cybercrime has skyrocketed from $3 trillion (€2.9 trillion) in 2015 to $6 trillion (€5.7 trillion) in 2021. Analysts predict this figure will soar to $15.6 trillion (€14.9 trillion) by 2029.

The cybersecurity market is expanding in response. A McKinsey report estimates that global spending on cybersecurity products and services reached approximately $200 billion (€191 billion) in 2024.

Dream’s latest funding round will also bring in new board members, including Enrique Salem of Bain Capital Ventures and Shlomo Yanai, a board member at Philip Morris. They will join existing board members Dovi Frances, Michael Eisenberg, and Dream’s founding team.

As the AI arms race in cyber warfare intensifies, Dream aims to position itself as a key player in protecting national security interests worldwide.

News

New Tool Reveals Hidden Environmental Cost of Internet Use

Scientists have developed a tool that shows how everyday internet activity impacts nature, revealing surprising environmental costs behind routine website visits. The internet is responsible for 3.7 percent of global carbon emissions, surpassing air travel. If the internet were a country, it would rank as the fourth-largest polluter in the world.

The tool, called Digital Impact for Species, was created by climate experts at the University of Exeter in partnership with Madeby.studio. It allows users to enter any website URL and see its hidden environmental footprint, including CO2 emissions, energy use, and water consumption.

“When we visit a website, we rarely think about the environmental impact,” said Dr. Marcos Oliveira Jr, project lead for Exeter’s nature and climate impact team. “But there is a high cost, from the energy consumed as the information travels from the data centre to your device, to the water used to cool servers.”

The tool translates environmental metrics into relatable natural comparisons. For example, YouTube.com, which processes billions of searches each month, is rated C, indicating room for improvement. Each page view generates 0.249 grams of CO2, consumes 0.0011 litres of water, and uses 0.62 watt-hours of energy. For every 9,000 monthly visits, the site requires 10 litres of water—enough to sustain a capuchin monkey for 77 days. CO2 emissions from that traffic would take a single Amazon rainforest tree 41 days to absorb, while the energy used is equivalent to 1,000 Anna’s hummingbirds’ daily energy consumption for 332 days.

The tool calculates these impacts using Google PageSpeed Insights to measure the size of resources loaded on a page, such as images, text, and video. It also checks whether the site is hosted on servers powered by renewable energy or fossil fuels, and applies the Sustainable Web Design Model to convert technical data into ecological terms.

Researchers said the tool is intended to raise awareness rather than criticize specific websites. Dr. Oliveira Jr explained that it encourages discussion on how to create a more sustainable internet.

Experts suggest that website operators can reduce environmental impacts by simplifying pages, using fewer images, limiting fonts, avoiding unnecessary videos, and optimizing code. Hosting sites on renewable-energy servers also lowers the ecological footprint.

Consumers can contribute by minimizing unnecessary searches, but the responsibility largely lies with website hosts and developers. By making these changes, experts say it is possible to lower the internet’s environmental impact while maintaining accessibility and usability.

Digital Impact for Species is available online, offering a way for users to better understand the hidden cost of their digital habits and prompting both individuals and organizations to consider sustainability in online activity.

News

European Police Dismantle 24 Labs, Seize 1,000 Tonnes of Chemicals in Major Synthetic Drug Bust

European authorities have dismantled 24 industrial-scale laboratories and seized around 1,000 tonnes of chemicals used to produce synthetic drugs, dealing what officials called a “massive blow” to organized crime in the region. The drugs involved include MDMA, amphetamines, and methamphetamine.

Europol described the operation as the largest of its kind to date. “I’ve been in this business for a while. This is by far the largest-ever operation we did against synthetic drug production and distribution,” said Andy Kraag, head of Europol’s European Serious Organised Crime Centre. He added that the crackdown targeted groups responsible for the production and trafficking of synthetic drugs across multiple countries.

The year-long investigation involved law enforcement agencies from Belgium, the Czech Republic, Germany, the Netherlands, Poland, and Spain. Authorities arrested more than 85 individuals, including two suspected ringleaders from Poland. While most of those arrested were Polish nationals, Belgian and Dutch citizens are also believed to have participated in the criminal operations.

The investigation began in 2024 after Polish police identified a network importing large quantities of legal chemicals from China and India. Authorities later discovered that the chemicals were being repackaged, mislabelled, and distributed across the European Union to laboratories manufacturing synthetic drugs.

Kraag said the operation was part of a broader “supply-chain strategy” aimed at cutting off synthetic drug production at its source. “These criminal groups, they don’t have their supply anymore,” he said, noting that disrupting the flow of chemicals is key to dismantling the industry.

The operation also highlighted the wider risks associated with synthetic drug production. Beyond public health dangers, synthetic drug labs contribute to violence, corruption, and money laundering. Authorities seized more than 120,000 litres of toxic chemical waste, which criminals often dump on land or into waterways, creating serious environmental hazards. “Today, it’s profit for criminals. Tomorrow, it’s pollution,” Kraag said.

Europol stressed that while this operation targeted one of Europe’s largest synthetic drug distributors, other networks remain active. “This is one of the biggest distributors. But it’s not the only one. So we’re still looking,” Kraag warned.

Officials said the crackdown would disrupt supply chains across multiple countries and reduce the availability of synthetic drugs in European markets. The operation reflects growing international cooperation in tackling organized crime and the dangers posed by large-scale drug production, both to public health and the environment.

News

Climate Concerns Rise Over Sponsorships at 2026 Winter Olympics

The 2026 Winter Olympics in northern Italy are facing mounting criticism over the environmental impact of their sponsorship deals, with scientists and athletes warning that the Games’ carbon footprint could threaten the future of winter sports.

A report by Scientists for Global Responsibility and the New Weather Institute, titled Olympics Torched, estimates that the Games themselves will produce around 930,000 tonnes of CO2 emissions. However, just three sponsorship agreements with major corporations could add 1.3 million tonnes more, more than doubling the total impact. The sponsors identified are oil and gas company Eni, car manufacturer Stellantis, and Italy’s national airline, ITA Airways, with Eni responsible for over half of the added emissions.

The report warns that the combined emissions could result in the loss of 5.5 square kilometres of snow cover in the Dolomites, equivalent to more than 3,000 Olympic-sized ice hockey rinks. Organisers have already announced plans to produce 2.4 million cubic metres of artificial snow for the Games, requiring 948,000 cubic metres of water, as warming temperatures continue to reduce natural snow and glaciers in the region.

“Even without the growing mountain of scientific evidence on the impact of global heating on winter sports, it is plain enough to anyone visiting actual mountains that snow cover is being lost and glaciers are melting,” said Stuart Parkinson, director of Scientists for Global Responsibility. He added that winter sports contribute directly to climate change through emissions and indirectly by promoting major polluters through sponsorship.

The report calls for urgent action, urging the Winter Olympics to end partnerships with high-carbon corporations, avoid new venue construction, and reduce spectator travel by air. Swedish cross-country skier Björn Sandström said the Games’ greatest influence is the signal they send to the world. “When that signal is driven by fossil-fuel sponsorship, it directly contradicts climate science and threatens the future of winter sport,” he said.

Greenlandic biathlete Ukalew Slettermark echoed the concern, arguing that giving oil companies a platform at the Games is unjustifiable. “It’s a complete contradiction when the fossil fuel industry, the biggest contributor to climate change, is allowed to sponsor winter sports, which they are simultaneously threatening,” she said.

The report also highlights broader environmental challenges in the Alps. Italy has lost 265 ski resorts in the past five years due to rising temperatures, and recent studies show mountain regions are warming faster than lowland areas, putting winter sports at risk.

The Milan-Cortina Olympics, spread across the Dolomites, have become a focal point for debates about climate responsibility in global sporting events. Critics say sponsorship deals with polluting corporations undermine efforts to promote sustainability and could damage the credibility of winter sports in a warming world.

Euronews Green has reached out to the International Olympic Committee for comment.

-

Entertainment1 year ago

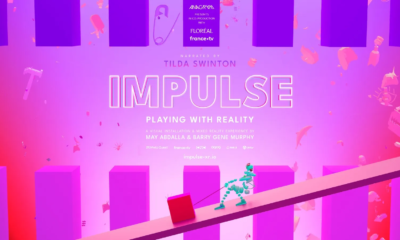

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports1 year ago

Sports1 year agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1