Business

Nvidia Set to Join Dow Jones Industrial Average as Intel Departs Amid Shift in Tech Industry

– Nvidia, a leading artificial intelligence and semiconductor company, will replace Intel in the Dow Jones Industrial Average (DJIA), according to an announcement from S&P Global on November 1. This change, set to take effect before trading on November 8, marks a significant shift in the DJIA’s technology sector representation as Nvidia’s value and influence in AI technology continue to surge.

The DJIA, one of Wall Street’s most established indices, tracks 30 prominent publicly traded companies across multiple sectors. Unlike the market-cap-weighted S&P 500, the DJIA is price-weighted, meaning companies with higher stock prices have a greater impact on the index’s performance. Nvidia’s recent 10-for-1 stock split, which aimed to make its shares more accessible to investors, has facilitated its addition to the index by reducing its weight on the overall average.

The inclusion of Nvidia, known for its pivotal role in the AI industry and strong financial performance, underscores its rise as a key player in the tech sector. While the change solidifies Nvidia’s status, analysts note that it may not trigger a major buying rush, as most index-tracking investments focus on broader indices like the S&P 500.

In a related move, Dow Inc. will be replaced by Sherwin-Williams Co., reflecting the DJIA’s goal to represent the evolving materials sector. The index update intends to provide “a more representative exposure to the semiconductor and materials industries,” according to S&P Global’s statement.

Nvidia’s Meteoric Rise in Market Valuation

Nvidia’s rapid growth aligns with the AI boom that has propelled its stock value and market position. In June, Nvidia briefly surpassed Apple as the world’s most valuable company, achieving a 20% weighting within the S&P 500’s Technology Select Sector SPDR Fund (XLK). Nvidia’s current market valuation stands at $3.34 trillion, just $20 billion shy of Apple, underscoring its potential to become the world’s largest company by market cap once again.

The demand for Nvidia’s new Blackwell AI chips has been a key driver of its stock price, which has surged by 174% this year alone. Analysts report that Blackwell chip production is fully booked for the next year, with Nvidia’s CEO Jensen Huang describing the demand as “insane.” As Nvidia prepares to release its fiscal third-quarter earnings for 2025 next month, investors are expected to closely monitor the results for further insights into the company’s trajectory.

Intel Faces Challenges Amid Nvidia’s Ascent

For Intel, once a dominant force in technology, the replacement in the DJIA marks a challenging period. The company, which has long supplied central processing units (CPUs) for personal computers, has been facing intense competition from Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing Co. in the AI chip market. Intel’s market valuation has dropped significantly, and its share price recently hit a decade low.

In response, Intel has initiated a series of cost-cutting measures, including layoffs and facility closures, as it works to address its competitive position. Reports indicate that parts of Intel’s operations may even be targeted for acquisition by rival companies.

The shift in the DJIA highlights Nvidia’s growing dominance in the tech sector and reflects the transformative influence of AI on global markets. As Nvidia continues its upward trajectory, Intel’s efforts to revamp its business model illustrate the increasing pressure traditional tech companies face amid fast-evolving industry dynamics.

Business

IMF Warns of Trade Tensions and AI Market Risks as Global Growth Remains Resilient

The International Monetary Fund (IMF) has highlighted trade tensions and a potential slowdown in the artificial intelligence (AI) sector as major risks to the global economy, even as it described growth prospects for 2026 as “resilient.”

In its latest World Economic Outlook, the IMF projected global growth at 3.3% this year, up from its previous forecast of 3.1%, before easing slightly to 3.2% in 2027. IMF chief economist Pierre Olivier Gourinchas said the world economy has been “shaking off the trade disruptions of 2025” and emerging stronger than expected, despite recent threats from US President Donald Trump to impose tariffs on eight European countries opposed to his Greenland proposal.

While AI-driven investment has supported growth, the IMF warned that overly optimistic expectations could trigger a market correction, with even a mild downturn affecting household wealth and corporate investment. “It doesn’t take as much of a market reaction to have an impact on people’s wealth relative to their income, so they start cutting consumption and businesses change their investment plans,” Gourinchas said.

Trade tensions remain another concern. The IMF cautioned that political or geopolitical conflicts could disrupt supply chains, commodity prices, and financial markets, weighing on global activity.

The report also stressed the importance of central bank independence for macroeconomic stability and long-term growth. Maintaining legal and operational independence allows central banks to anchor inflation expectations and avoid fiscal pressures. Gourinchas noted that pressures on central banks, particularly in countries with high borrowing needs, can lead to higher inflation and borrowing costs over time.

The IMF’s forecast for the United Kingdom showed slightly stronger growth than previously expected. The UK economy grew by 1.4% in 2025, up from a prior estimate of 1.3%, and is expected to expand 1.3% this year, making it the third-fastest growing G7 economy after the US and Canada. Growth is projected to rise to 1.5% in 2027. Chancellor Rachel Reeves described the figures as evidence that the UK is “on course to be the fastest growing European G7 economy this year and next,” while shadow chancellor Sir Mel Stride dismissed the increase as modest.

Inflation is expected to ease globally, falling from 4.1% in 2025 to 3.8% in 2026 and 3.4% in 2027. In the UK, inflation is projected to return to the 2% target by the end of the year as a weakening labour market keeps wage growth subdued.

Gourinchas said challenges to central bank independence, such as political pressure to keep interest rates low, have emerged in several countries. He warned that undermining central banks tends to produce inflation and higher borrowing costs, calling it “self-defeating.”

The IMF report comes amid heightened scrutiny of global central banks, including the US Federal Reserve, following recent legal investigations and political disputes, underscoring the fund’s emphasis on safeguarding institutional independence as a cornerstone of economic stability.

Business

China Reports 5% Economic Growth Amid Record Trade Surplus and Domestic Challenges

China said its economy grew by 5% in 2025, meeting the government’s official target despite a slowdown to 4.5% in the final quarter of the year, driven in part by a record trade surplus.

The world’s second-largest economy faced a year of weak domestic spending, a prolonged property market downturn, and ongoing uncertainty from US tariff policies. Analysts describe the figures as reflecting a “two-speed economy,” with manufacturing and exports supporting growth while consumer spending remains cautious and the housing sector continues to weigh on overall activity.

Some economists question the official numbers. Zichun Huang, a China economist at Capital Economics, said the figures “overstate the pace of economic expansion” by at least 1.5 percentage points, citing weak investment and subdued household consumption.

Data released on Monday also highlighted China’s deepening demographic challenges. The number of births fell to 7.9 million in 2025, the lowest since records began in 1949. The country’s population declined for the fourth consecutive year, dropping 3.4 million to 1.4 billion. Experts warn that falling birth rates could reduce demand for housing and consumer goods, adding pressure to an already struggling property market.

The property sector remains a key concern. House prices continued to fall in December, dropping 2.7% year-on-year, marking the sharpest decline in five months. Property investment fell 17.2% for the year. The prolonged slump affects construction activity, household wealth, and local government finances, leaving millions of homeowners with unfinished or devalued properties.

Retail sales rose only 0.9% in December, the slowest pace in three years, while factory output increased 5.2%, slightly up from November’s 4.8%. Analysts say export growth and manufacturing output are currently propping up the economy, while domestic consumption remains weak.

China recorded a record trade surplus of $1.19 trillion in 2025, driven by strong exports outside the United States. Alicia Garcia-Herrero, chief economist for Asia Pacific at Natixis, warned that “China is effectively pushing growth through exports at a loss,” a strategy that may not be sustainable as it can undermine profits and long-term expansion.

Speaking on Monday, Kang Yi, head of China’s National Bureau of Statistics, acknowledged the economy “faces problems and challenges, including strong supply and weak demand,” but said China can “maintain stable, sound growth momentum this year.”

Analysts say China faces a delicate balancing act. Policymakers aim to support growth through targeted stimulus and boost consumer confidence while avoiding excessive debt and reducing reliance on exports amid ongoing global trade tensions, including uncertainty over US tariff policies.

While China officially met its growth target, the underlying economic picture suggests caution. Weak domestic demand, a fragile property market, and demographic shifts indicate that sustaining long-term growth will require careful management of both fiscal and monetary policy.

Business

Stablecoins Hit Record Transaction Volumes as Governments and Firms Embrace Digital Payments

Stablecoins recorded a historic year in 2025, as both governments and private companies encouraged their adoption across financial systems worldwide. Total transaction volumes surged 72 percent over the year, reaching $33 trillion (€28 trillion), according to Artemis Analytics.

Unlike traditional cryptocurrencies, stablecoins are designed to maintain a stable value by pegging themselves to real-world assets, most commonly the US dollar. They are fully backed by reserves such as treasury bills or cash, allowing holders to redeem them on a 1:1 basis. More than 90 percent of stablecoins in circulation are dollar-pegged, with Tether’s USDT holding a market cap of $186 billion (€160 billion) and Circle’s USDC at $75 billion (€65 billion). In 2025, Circle processed $18.3 trillion (€15.7 trillion) in transactions, while USDT handled $13.3 trillion (€11.4 trillion).

A report by venture capital firm a16z highlighted that stablecoins facilitated at least $9 trillion (€7.7 trillion) in “real” user payments last year, an 87 percent increase from 2024. Analysts noted that this volume is more than five times that of PayPal and over half of Visa’s annual transaction throughput.

Central banks have also taken notice of the growing adoption of digital currencies. In addition to private stablecoins, several governments are developing central bank digital currencies (CBDCs). China’s digital yuan has been in pilot phases since 2019, while the European Central Bank is preparing to issue a digital euro, targeting 2029 for the first launch. McKinsey data shows that cash still accounts for 46 percent of global payments, but non-digital transactions are declining, particularly in developed countries with strong digital infrastructure.

The United States has taken a different approach. In January 2025, President Donald Trump signed an executive order blocking any government action to issue CBDCs, clearing the way for private stablecoins to dominate. Trump later approved the GENIUS Act, which established a comprehensive regulatory framework requiring stablecoin issuers to maintain full 1:1 reserve backing with liquid assets. The framework aims to ensure stability and encourage confidence in the use of digital dollars.

In Europe, stablecoin adoption continues under the EU’s Markets in Crypto-Assets (MiCA) regulation. By July 2026, firms must secure a Crypto-Asset Service Provider (CASP) licence to operate legally. Payments company Ingenico recently partnered with WalletConnect to allow merchants to accept stablecoins, including USDC and EURC, using existing terminals. WalletConnect’s CEO, Jess Houlgrave, said that while MiCA is not perfect, “some regulatory clarity is better than none,” and called for uniform enforcement to prevent regulatory shopping.

Crossmint, a stablecoin infrastructure provider, also secured a MiCA licence in Spain this week. General counsel Miguel Zapatero noted that obtaining the licence is costly but increases credibility, with other regulators often fast-tracking approvals for licensed firms.

As private stablecoins gain traction and CBDCs slowly roll out, 2025 marked a turning point in the integration of digital currencies into mainstream financial systems, showing strong institutional and corporate adoption while highlighting the global push for regulatory clarity.

-

Entertainment1 year ago

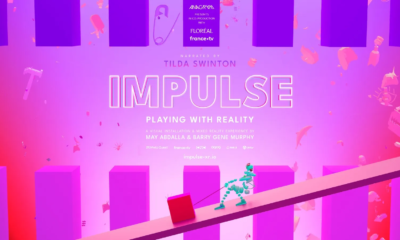

Entertainment1 year agoMeta Acquires Tilda Swinton VR Doc ‘Impulse: Playing With Reality’

-

Business2 years ago

Business2 years agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business2 years ago

Business2 years agoRecent Developments in Small Business Taxes

-

Home Improvement1 year ago

Home Improvement1 year agoEffective Drain Cleaning: A Key to a Healthy Plumbing System

-

Politics2 years ago

Politics2 years agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business2 years ago

Business2 years agoCarrectly: Revolutionizing Car Care in Chicago

-

Sports1 year ago

Sports1 year agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m

-

Business2 years ago

Business2 years agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1