Business

Business

European Markets Slide as U.S.-China Tariff Tensions Escalate

European stock markets slipped on Monday afternoon as renewed trade tensions between the U.S. and China unsettled investors, reigniting fears of a prolonged global trade dispute.

By 13:05 CEST, all major European indexes were trading in negative territory. The EURO STOXX 50 had dropped 0.68%, Germany’s DAX was down 0.48%, and France’s CAC 40 had fallen by 0.63%.

The downturn followed comments from Beijing accusing the United States of “severely violating” the terms of their recent trade agreement, prompting concerns of a fresh round of retaliatory measures. Investors were also reacting to U.S. President Donald Trump’s announcement that tariffs on steel and aluminium imports would be doubled from 25% to 50% starting Wednesday.

“Donald Trump has upset markets once again,” said Russ Mould, investment director at AJ Bell, in a note shared with Euronews. “Doubling import taxes on steel and aluminium, and aggravating China once again, mean we face a situation where uncertainty prevails. Trump’s continuous moving of the goalposts is frustrating for businesses, governments, consumers, and investors.”

Market sentiment soured across Europe and Asia, with futures suggesting a similarly weak open for Wall Street later in the day. In response to rising uncertainty, investors turned to safe-haven assets, giving gold a boost.

U.S. Market Outlook Mixed

While U.S. equity markets ended May relatively flat, major indices posted solid gains over the month, lifted by earlier optimism around easing trade tensions. However, that sentiment is now under pressure.

“The latest broadsides from the White House were primarily directed at China and the EU, with both threatening a response in kind to any further tariff hikes,” said Richard Hunter, head of markets at Interactive Investor.

Still, there were some encouraging economic signals. The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures index, came in lower than expected, while consumer sentiment surprised on the upside. Analysts caution, however, that these may be temporary reprieves.

Looking ahead, attention is turning to U.S. non-farm payroll data due at the end of the week. Economists forecast 130,000 new jobs added in May, down from 177,000 the previous month, with unemployment expected to hold at 4.2%.

Despite recent gains, U.S. markets remain fragile. Year-to-date, the Dow Jones is down 0.6%, the Nasdaq 1%, while the S&P 500 has managed a modest 0.5% rise, bolstered in part by strength in large-cap tech stocks.

Asian Markets Also Weigh Trade and Geopolitics

Asian markets also came under pressure. The Hang Seng index fell amid renewed concerns over U.S. tariffs and geopolitical uncertainty stemming from ongoing Russia-Ukraine tensions.

Mainland China’s markets were closed for a public holiday, but investors expect potential losses upon reopening, particularly after recent data showed further contraction in factory activity.

With trade tensions heating up again, global markets are bracing for a volatile start to June.

Business

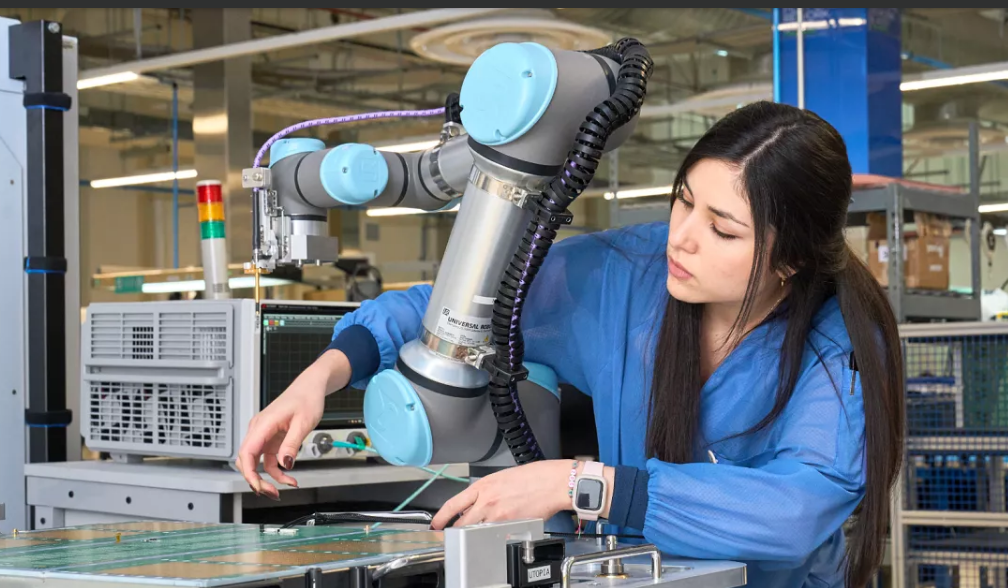

Costa Rica Emerges as High-Tech Powerhouse with Sustainable Growth Model

Business

Financial Influencer Jenny Okpechi Shares How Early Investing Helped Her Build a Six-Figure Portfolio

Financial influencer Jenny Okpechi, known online as @savvymoneygirl, is championing the power of early and consistent investing after building a multiple six-figure portfolio through smart financial planning and diversified income streams.

Speaking to Euronews, Okpechi emphasized that wealth-building is a long-term process rooted in discipline, education, and strategic action—not overnight success. Her financial journey began at just 16, when she started saving and investing small amounts despite limited resources.

“I started very young and very intentionally,” she said. “I learned to budget, live within my means, and gradually moved from saving to investing in treasury bills, corporate bonds, and stocks.”

Raised in a traditional African household where financial decision-making was often seen as a male role, Okpechi had to push against cultural barriers. “I wanted to prove that women could manage and grow money just as well,” she said. That determination led her to pursue multiple sources of income while also studying, including paid surveys, tutoring, and blogging.

Today, Okpechi boasts eight income streams, ranging from her full-time job as a Scrum Master and a part-time healthcare assistant role, to digital product sales, affiliate marketing, brand collaborations, and investments in REITs, index funds, and stocks. She is also building Moneybestie, a fintech app aimed at improving financial literacy among women and girls.

“I pay myself first and invest consistently. I only invest in what I understand—nothing fancy, just steady and simple,” she said. She credits compound interest and the discipline of regular investing as major factors in her portfolio growth.

Okpechi encourages young people to start investing early—even with small amounts. “Don’t wait until you earn more. Start with £25 a month if that’s all you can. Automate it, and let time do the work,” she advised. “Time in the market beats timing the market.”

Despite her success, Okpechi has faced challenges—from overcoming imposter syndrome in the male-dominated finance and tech industries to battling burnout while juggling multiple roles. She also confronted deep-rooted gender biases that undervalue women’s financial potential.

Her message to aspiring investors is clear: “Learn about money like your financial freedom depends on it—because it does. Talk about money, forgive your financial mistakes, and keep moving forward.”

With Generation Z reportedly beginning to invest earlier than previous generations—at an average age of 19—Okpechi’s story offers both inspiration and practical guidance for anyone looking to secure their financial future.

-

Business1 year ago

Business1 year agoSaudi Arabia’s Model for Sustainable Aviation Practices

-

Business1 year ago

Business1 year agoRecent Developments in Small Business Taxes

-

Politics1 year ago

Politics1 year agoWho was Ebrahim Raisi and his status in Iranian Politics?

-

Business11 months ago

Business11 months agoCarrectly: Revolutionizing Car Care in Chicago

-

Business11 months ago

Business11 months agoSaudi Arabia: Foreign Direct Investment Rises by 5.6% in Q1

-

Technology1 year ago

Technology1 year agoComparing Apple Vision Pro and Meta Quest 3

-

Politics1 year ago

Politics1 year agoIndonesia and Malaysia Call for Israel’s Compliance with ICJ Ruling on Gaza Offensive

-

Sports10 months ago

Sports10 months agoKeely Hodgkinson Wins Britain’s First Athletics Gold at Paris Olympics in 800m